HCM Insights

DIVYS 3Q 24 “A Market in Transition”

In our prior quarterly letter, we expressed concerns regarding the alarmingly narrow market breadth, heavily influenced by a select group of mega-cap technology companies. However, the third quarter has ushered in a notable shift, highlighted by increased market participation across various sectors. In a mere three months, the prevailing focus on disinflation, optimistic earnings projections, and anticipated prolonged high interest rates gave way to a more intricate economic landscape. As such, this evolving scenario now features softening employment data alongside dovish signals from the Federal Reserve. Although market discussions are polarized between ‘hard’ or ‘soft’ economic landing forecasts, the Investment Committee’s analysis suggests a more complex and multifaceted outcome. Consequently, a combination of external and internal factors – including upcoming U.S. elections, escalating geopolitical tensions, fluctuating employment data, and evolving interest rates – is poised to amplify market volatility as we approach year-end.

In the face of a macroeconomic environment characterized by mixed signals, market breadth significantly widened, as evidenced by the S&P 500 Equal Weight index outperforming its market-weight equivalent by approximately 375 basis points during the quarter. Moreover, the shift in market sentiment surrounding Federal Reserve Policy has led a reversal of several key trends from the prior quarter, as seen with the outperformance of small caps over large-cap stocks, a shift to value from growth, and a preference for dividend payers over non-yielding companies.

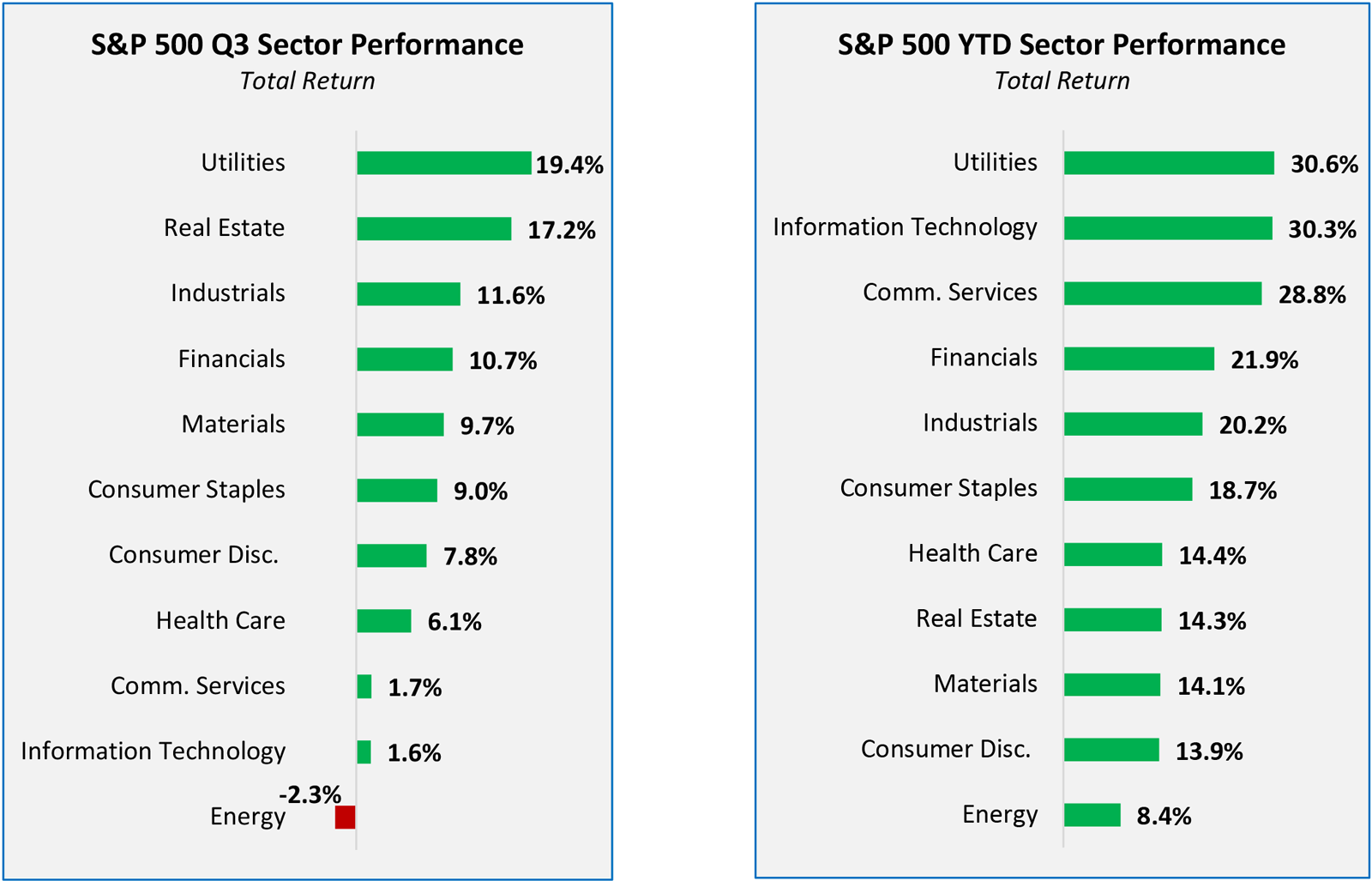

Figure 1: Q3 v. YTD S&P 500 Sector Returns

Figure 1: Q3 v. YTD S&P 500 Sector Returns

Source: Bloomberg

As shown on the above, Figure 1 highlights a material reversal in large-cap sector performance. While Information Technology and Communication Services dominated index performance during the first half of 2024, the third quarter marked a significant shift in sector leadership. Utilities emerged as the top-performing sector, with Financials, Industrials, and Consumer Staples staging impressive rallies, substantially boosting their year-to-date gains.

Market Tailwinds During 3Q:

- Disinflation: Core PCE at ~2.6%.

- Easing Financial Conditions: 2YR down ~111bps / 10YR down ~62bps.

- Rising 3Q/4Q and FY ’25 Earnings Expectations.

- Stronger Revised Savings Ratio: ~5% v. <3.5% pre-revision.

- Weakening USD.

- Narrowing US Corp High Yield – 10YR spreads.

- Expanding Market Breadth: S&P 500 Equal Weight Outperforms.

- 3Q24 GDP at +3.0%.

Market Headwinds During 3Q:

- Weakening Employment: Sahm Rule Triggered / Lower US Job Openings.

- Concerns on Return on Investment in AI.

- Greater Equity Volatility: VIX up >3pts.

- Heightened Equity Valuations.

- Geopolitical Tensions in Europe and Middle East.

- S. Election Uncertainty.

DIVYS Strategy 3Q24 Review:

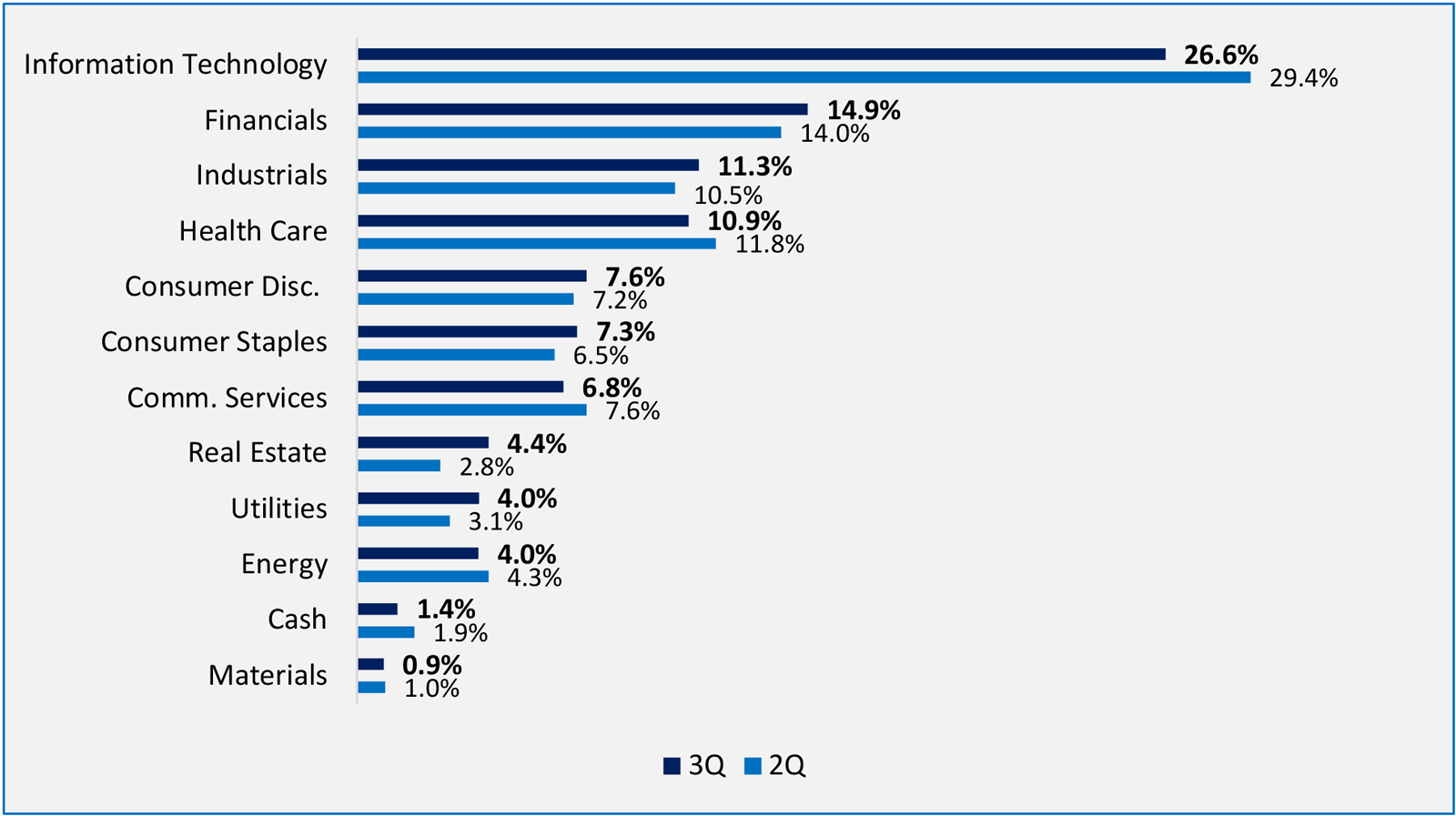

Throughout the third quarter, the Hilton Capital Investment Committee strategically managed portfolio risk, implementing nuanced yet significant allocation adjustments to align with evolving market conditions. In response to market dynamics, the team strategically adjusted sector allocations. Information Technology exposure was trimmed to 26.5% from 29.4% and Health Care was reduced to 10.9% from 11.9%. Conversely, the Investment Committee increased positions in Industrials (11.3% from 10.5%), Real Estate (4.4% from 2.8%), and Financials (14.9% from 14%). While aligned with our broader macroeconomic view, these adjustments were primarily driven by rigorous bottoms-up analysis of individual stocks.

Performance: The Hilton Dividend & Yield strategy demonstrated solid performance in the third quarter of 2024, delivering a return of 6.57% gross / 6.44% net. While this performance was commendable, it trailed the benchmark* return of 9.51% by 294 basis points gross / 307 basis points, net. However, the strategy's year-to-date performance has been strong, with the portfolio delivering a robust 22.04% gross return and 21.57% net return. This impressive performance significantly outpaced the benchmark's 18.63% year-to-date return. Notably, the portfolio demonstrated solid momentum in the quarter's final month, recapturing approximately 100 basis points of relative performance.

Figure 2: DIVYS 3Q v. 2Q Sector Weights

Figure 2: DIVYS 3Q v. 2Q Sector Weights

Source: Bloomberg

Figure 3: DIVYS Year-to-Date Performance Relative to Benchmark* ETF

Figure 3: DIVYS Year-to-Date Performance Relative to Benchmark* ETF

Source: Bloomberg

Portfolio Adjustments:

Early in the quarter the portfolio exited its position in Rockwell Automation (ROK) and initiated a stake in Schneider Electric (SBGSY US ADR). Considering Rockwell’s persistent operational challenges, the Committee strategically decided to divest the ROK position, reallocating the capital to initiate a position in Schneider Electric. For Schneider Electric, the Investment Committee was compelled by the company’s well-established market share in industrial electrification and digitalization products, notably data-center switchboards. As for large-cap technology, the team continued to reduce and ultimately sold its positions in Nvidia (NVDA) and Applied Materials (AMAT) and trimmed positions in Microsoft (MSFT), Taiwan Semiconductor (TSM), Apple (AAPL), Oracle (ORLC), and S&P 500 Communications ETF (XLC).

The Investment Committee strategically exited and reduced its semiconductor and AI-related technology names given broader AI-CapEx spend concerns surrounding return on invested capital. Consequently, the team believes it identified more compelling capital allocation opportunities across the broader market, particularly in the Financials, Industrials, Real Estate, and Utilities sectors. This strategic shift reflects the Investment Committee’s commitment to optimizing portfolio performance by potentially capitalizing on emerging market dynamics and sector-specific trends, as evidence by the portfolio’s early holdings in AI-related semiconductor names.

With this, the team initiated on Bank of America (BAC), Public Storage (PSA), Itochu Corp. (ITOCY US ADR), and American Healthcare REIT (AHR) while increasing the portfolio’s positions in Avalon Bay (AVB), and S&P 500 Utilities (XLU). Broadly, the Committee believes these selections are well-positioned to capitalize on a declining interest rate environment without assuming undue beta risk given their attractive valuations. For Itochu Corp., the position represents a wider trend to increase geographic diversification exposure to high-quality international compounders at discounted prices. For the Company specifically, the team believed that Itochu’s broad exposure to international markets, primarily textiles, manufacturing, technology, and energy, mixed with a long-term history of compounding book value at a low-double digit rate would be a great fit for the portfolio’s lower-beta value-oriented strategy.

Moreover, the Committee’s reductions and divestitures in several large-cap technology positions were also partially deployed into rate-sensitive, cyclical technology opportunities. Many of these newly acquired positions represent secondary or tertiary beneficiaries that the Committee believes are poised to capitalize on the burgeoning AI ecosystem. Accordingly, the Investment Committee initiated positions in Analog Devices (ADI), Seagate Technologies (STX), Corning (GLW) and IBM Corp. (IBM). Beyond each company’s strengthening fundamentals, these strategic acquisitions also enhance the portfolio’s overall yield profile. Separately, the Investment Committee trimmed Visa (V), Ares Management (ARES), and Apollo (APO) to de-risk the broader portfolio from significant gains in the space. As for Visa, the team successfully got ahead of recent anti-trust headwinds mixed with broader consumer concerns.

Later in the quarter, the Investment Committee exited its position in L3 Harris (LHX) due to lagging operational performance relative to other A&D peers and divested its stake in Novo Nordisk (NVO US ADR). This decision was driven by the Committee’s assessment that ongoing pricing pressures, capacity limitations, and increasing regulatory scrutiny could potentially impact Novo-Nordisk's performance relative to competitors, particularly Eli Lilly (LLY). Additionally, within healthcare, the group initiated a position in Quest Diagnostics (DGX), increased its position in United Healthcare (UNH) and sold its investment in Becton Dickinson (BDX). The Investment Committee views both Quest Diagnostics and United Health’s valuation as particularly attractive, given its defensive growth characteristics as their respective management teams leverage their dominant and expanding market share. As for Becton Dickinson, the Committee divested its position after years of holding, citing concerns about management's ability to streamline the company's complex portfolio.

Quick snapshot of 3Q Attribution:

- Average allocation to cash was up slightly at 2.3%, however, new positions were primarily funded with existing positions.

- Yield on the portfolio as of 09/30/2024 was 2.09% and the 1 year Beta was .0.82.

- The Dividend and Yield Strategy returned +6.57% gross /+6.44% net, which was -294 bp and -307 bp behind of the benchmark* return of +9.51%.

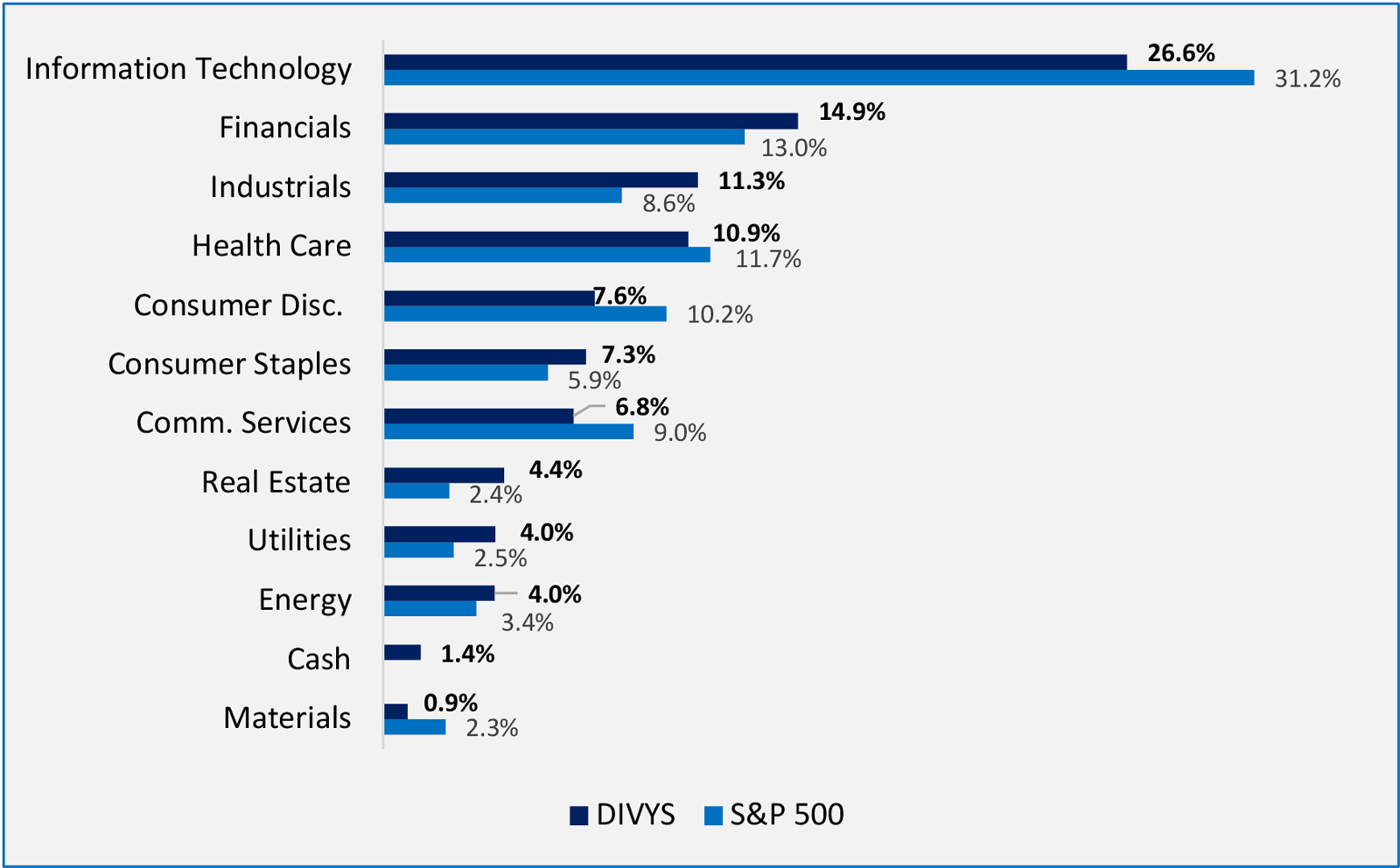

- Relative to the Nasdaq US Broad Dividend Achievers (DAATR), DIVYS was overweight Communication Services, Information Technology, Consumer Discretionary, and Real Estate.

- Relative to the Nasdaq US Broad Dividend Achievers (DAATR), DIVYS outperformed in Real Estate, Communications Services, and Consumer Discretionary.

- Top single-name contributors included XLU, XLC, CARR, PSA, LMT, ARES, PM.

- Top single-name detractors included NVDA, QCOM, AMAT, BAC, MSFT, WFC, BDX.

- Relative to the S&P500, DIVYS was overweight Industrials, Real Estate, Financials, Utilities, Consumer Staples, and Energy.

- New positions added during the quarter: SBGSY, BAC, ADI, IBM, STX, ITOCY, AHR, DGX, GLW.

- Positions sold during the quarter: BDX, ROK, NVDA, AMAT, LHX, NVO.

- The 3Q underperformance was primarily the result of the portfolio overweight semiconductors and large-cap growth. Additionally, relative performance was lost due to DIVYS initially underweight banks and deep-value oriented individual names.

- The DIVYS strategy continues to maintain a low standard deviation—one-year standard deviation of 8.5% vs benchmark* of 9.7% and S&P 500 of 11.4%.

Figure 4: Q3 DIVYS Sector Weight v. S&P 500

Figure 4: Q3 DIVYS Sector Weight v. S&P 500

Source: Bloomberg

As we look ahead, we believe our Dividend & Yield Strategy is well positioned to leverage the unfolding economic landscape, characterized by broadening growth prospects and favorable market conditions. This year’s performance underscores the effectiveness of our sector allocation approach in the current economic climate. Throughout recent quarters, we methodically rebalance our sector weightings, transitioning from a predominantly defensive posture to a slightly more pro-cyclical orientation. We believe this calibrated shift allows us to capitalize on emerging megatrends while maintaining a well-diversified portfolio. Our measured approach to sector reallocation reflects our commitment to capturing growth opportunities while managing risk in an evolving market environment.

*Dividend and Yield Benchmark = Nasdaq US Broad Dividend Achievers TR

All information set forth herein is as of September 30th, 2024, unless otherwise noted. This letter contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed herein will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Hilton Capital Management, LLC (“HCM”) is a registered investment adviser with its principal place of business in the State of New York. For additional information about HCM, including fees and services, send for our Form ADV using the contact information herein. Please read the Form ADV carefully before you invest or send money. Past performance is no guarantee of future results. All information set forth herein is estimated and unaudited.