HCM Insights

DIVYS Q1 23 Recap

Despite a challenging backdrop for dividend investing in Q123, the Hilton Dividend and Yield Strategy performed well. The strategy’s focus on risk adjusted returns resulted in outperformance versus its benchmark* during a quarter that experienced significant market headline risk and elevated volatility.

Market Commentary

First quarter 2023 was not an easy ride for investors. Despite very solid returns by the S&P (+7.48%) and the Nasdaq (+17.05%), the first quarter was much more stressful than the index returns would suggest. Headline risk and volatility were a constant and it presented many reversals in investment factors and styles which resulted in clear winners and losers. The year started off like a rocket, market optimism fueled by the notion the Fed was nearly done tightening, mortgage rates were falling, healthy employment and nothing in the economy had “broken”. However, two of the largest bank failures in US history coupled with another rate hike by the Fed disrupted markets and put a “hard landing” scenario back into view. But as the quarter ended, soft-landing hopes seemed to be winning in the tug-of-war versus hard landing fears and the markets experienced a risk on rally.

The equity markets experienced a second “risk-on” trade in early March. The collapse of Silicon Valley Bank and Signature Bank and tightening credit concerns had the markets quickly positioning for slower growth. The result was a massive move lower in interest rates, with 2yr yields collapsing over 100bp in a 5-day period. Lower rates put a strong bid under the large cap tech sector which created strong outperformance by the Nasdaq for the quarter. The breadth of the market gains was very narrow and there were clear Q1 winners: Large Cap over Small Cap; Growth over Value, High Quality over Leverage. From a sector perspective this played out with technology, communications, and discretionary outperforming financials, health care, utilities, and staples.

One of the biggest determinants of market direction over the past two years has been the easing or tightening of financial conditions. As the chart below illustrates, as financial conditions ease markets tend to rally. Such easing conditions can help explain the Q322 rally and the rally into the end of Q123.

Figure 1: Easing/Tightening of Financial Conditions

Dividend and Yield Strategy Q123 Review

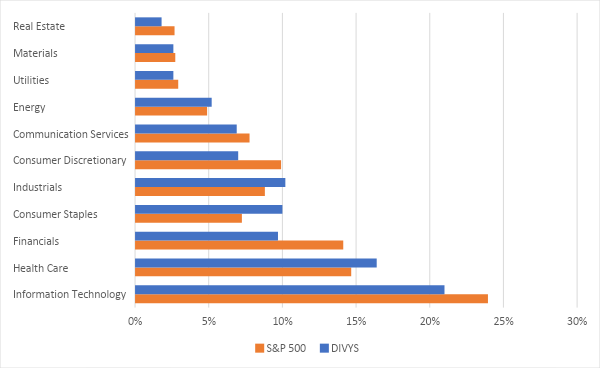

The Hilton Dividend and Yield Strategy maintained its defensive positioning entering 2023, as the Investment Committee remained cautious on economic growth and concerned with tightening economic conditions. Anticipating an elevated level of volatility, the portfolio was tactically allocated to provide a low volatility experience within the challenging economic backdrop. As Figure 1 shows, vs the S&P weightings, the DIVYS portfolio remained overweight Staples, Health Care, Utilities and underweight Info Tech, Financials, and Discretionary. The tactical underweight to Financials proved critical as the strategy avoided the drawdowns created by bank failures.

Figure 2: Portfolio Sector Weightings vs S&P 500

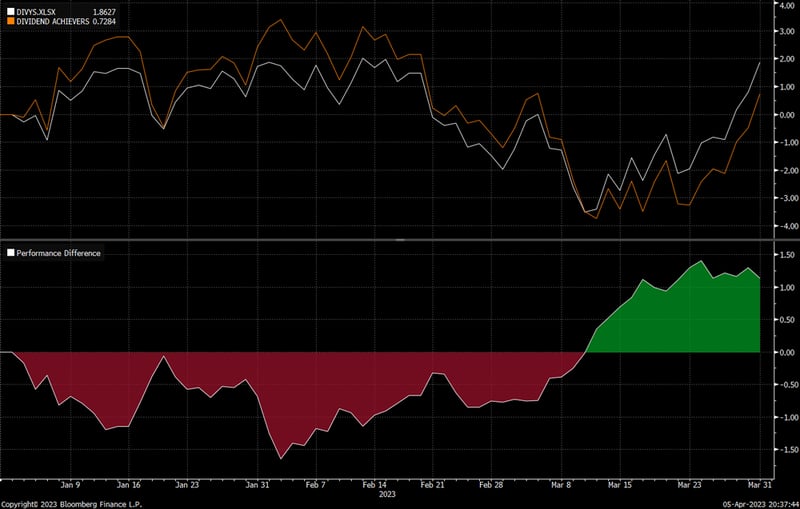

For Q123, DIVYS outperformed its benchmark* by 101bp gross and 90bp net. As Figure 3 illustrates, the strategy lagged the “low quality” rally to start 2023, but experienced significant outperformance when the market experienced elevated volatility on the back of bank failures. The 1Q outperformance was driven by the decision to remain defensive, the focus on high quality names and not chasing high valuations, excessive yields or lower quality.

Figure 3: Absolute Performance (top panel) & Relative Performance (bottom panel)

Quick rundown of Q1 Attribution:

- Average allocation to cash decreased to 4.8% (9.1% in 4Q22) as cash was deployed into various new starter positions.

- Yield on the portfolio as of 03/31/2023 was 2.26%

- The Dividend and Yields Strategy returned 1.85% gross /1.74% net, which was 101bp and 90bp ahead of the benchmark return of .84%.

- Relative to the benchmark*, overweighting technology (+1.53%) resulted in 55bps of outperformance, the best relative sector allocation. Technology’s contribution to relative return was driven by allocation and selection; DIVYS benefitted as investment returned to beaten-up mega caps and away from ultra-high valuation software. Underweighting financials (-6.84%) resulted in 50bps of outperformance, the second best sector allocation driven by selection and avoiding crises in the sector.

- Relative to the benchmark*, staples was the largest drag on return relative; primarily driven by selection.

- DIVYS relative allocation to the benchmark* and the broad market avoided broad financials exposure, a significant contributor to return.

- Relative to the S&P500, DIVYS remained defensive, overweight staples, healthcare, utilities, and industrials. DIVYS remained underweight technology, financials, consumer discretionary, communication services and real estate.

| Top Contributors to Return | Weight | CTR |

| Apple Inc | 4.39 | 1.06 |

| Microsoft Corp | 4.34 | 0.85 |

| iShares US Telecommunication | 3.41 | 0.21 |

| Bottom Contributors to Return | Weight | CTR |

| US Bancorp | 0.62 | -0.44 |

| UnitedHealth Group Inc | 2.74 | -0.32 |

| Johnson & Johnson | 2.40 | -0.30 |

2023 has proven to be a challenging year for investors. While robust Q1 equity performance has masked many of the struggles, we are far from an all-clear sign needed to justify adding significant risk to the portfolio. We feel slower growth and stubborn inflation will remain major themes in the coming quarters, and this creates a challenging backdrop for revenue growth and corporate margins. We anticipate an elevated level of volatility which can drive both drawdowns and bear market rallies. The Dividend and Yield Strategy will continue to maintain a defensive and high-quality bias and seek to provide stable returns and dividends within an uncertain economic and investment environment. The Investment Committee will continue to watch the economic data and the Fed closely, looking for signs of a true pivot in the economic cycle. Such a change would prove more durable and would spur significant changes in the portfolio. Until then we remain patient, and as always, vigilant.