HCM Insights

DIVYS Q1 24 Recap: Tale of Triumph

By all metrics Q1 2024 was an undeniably optimistic ride, underlined by the continuation of a soft landing, recession odds declining, inflation receding and rate cuts in the Fed queue. Economic data is supporting the optimism; the jobs picture remains strong, the inflation picture improving, despite a bumpy path, and GDP growth expectations remaining positive. Market follow-through was broad in nature; stocks and exposures outside of the Magnificent 7 joined the party and the S&P 500 put up another fabulous return of +10.6%. Dividend stocks did not disappoint, with the Achievers index generating an impressive +7.5% return in the quarter, slightly ahead of the S&P value at +8.0% in the same period.

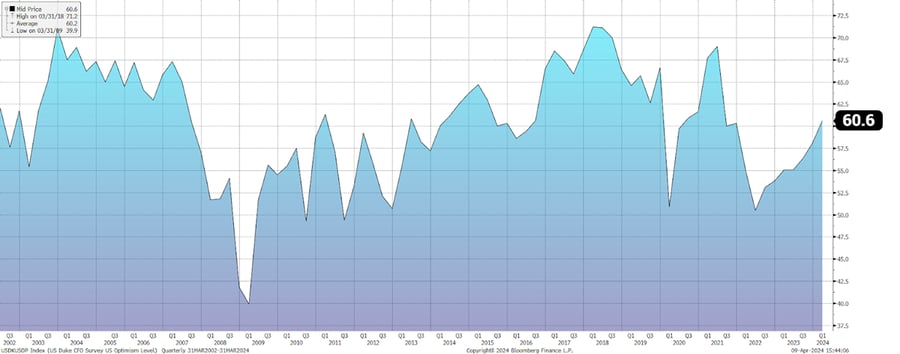

The rally picked up steam as the quarter ended, first from positive earnings reports, then a continued AI surge, followed by plenty of pontification about rate cuts. The Hilton Dividend and Yield Strategy (DIVYS) was no stranger to these events, participating in all of it. DIVYS benefitted from an especially strong slew of 4Q 2023 reports and forward guidance. The strategy was also able to participate in the AI-driven rally through NVDA, MSFT, TSMC, AVGO, ORCL among others. Lastly, the possibility but not reliance on rate cuts can make DIVYS an attractive strategy. The possibility of easing financial conditions is surely helping to drive CEO confidence which bodes well for additional dividend increases. Additionally, the companies in DIVYS have low leverage and strong cash flow, which should lead them to operate well in a higher for longer environment.

Figure 1: US Duke CFO Optimism Level Index

While any quarterly outlook will insist unloved ideas are soon to see appreciation, we view this concept as less contrarian in nature and more a further broadening of gains into 2Q, especially into value and quality. This sets the stage well for yield strategies in our view and represents a sizable opportunity for value to catch up to growth.

In the first quarter of 2024, our Dividend & Yield Strategy underwent significant strategic adjustments, demonstrating our proactive approach to portfolio management considering evolving market conditions and company-specific developments. Our decisions to sell, trim, and add positions were made with the intent to optimize performance and maintain alignment with our investment philosophy focused on long-term value and income generation.

We made the decision to completely sell our holdings in Cencora, seizing the opportunity after a strong performance in 2023, due to concerns over its extended valuation, which we deemed unsustainable for future growth despite previous positive catalysts. Additionally, we trimmed our position in UnitedHealth Group, acknowledging its attractive valuation but predicting limited future upside due to intense competition in the Medicare Advantage sector among other challenges.

On the acquisition front, we introduced Amgen and AbbVie into our portfolio, attracted by their compelling pipelines, strategic acquisitions, and potential for earnings per share growth and multiple expansion, despite looming patent expirations. These new positions reflect our confidence in their resilience and strategic fit within our income-oriented strategy.

In the technology sector, we exited our position in Cisco Systems amidst worries about the slowing demand for networking equipment, reallocating those funds towards companies like Applied Materials, Taiwan Semiconductor Manufacturing Company, and Broadcom. We believe these companies are well-positioned to capitalize on current industry trends and technological advancements, aligning with our strategy's growth objectives.

Further into the quarter, following the surprise acquisition announcement of our recently purchased M.D.C. Holdings, we reallocated those funds to Lennar Corporation, drawn by their innovative marketing strategies, strong cash flow generation, and shareholder-friendly initiatives. Additionally, we sold our position in Arthur J. Gallagher & Co., feeling its valuation fully reflected the industry's positive outlook, and trimmed our holdings in Coca-Cola to increase our investments in Oracle and Qualcomm, anticipating the potential impact of artificial intelligence on their future growth.

In the industrial sector, we slightly reduced our holdings in Lockheed Martin, Republic Services, and Waste Management to make room for Rockwell Automation. This decision was influenced by the increasing demand for automation and robotics amid geopolitical tensions and labor shortages, with Rockwell Automation poised to benefit from these trends, in our opinion.

For Q1 2024, DIVYS outperformed its benchmark* by 206bp gross and 193bp net. As Figure 2 illustrates, the Dividend and Yield strategy outperformed consistently during all three months of the quarter.

Figure 2: Absolute & Relative Performers vs Benchmark Q124

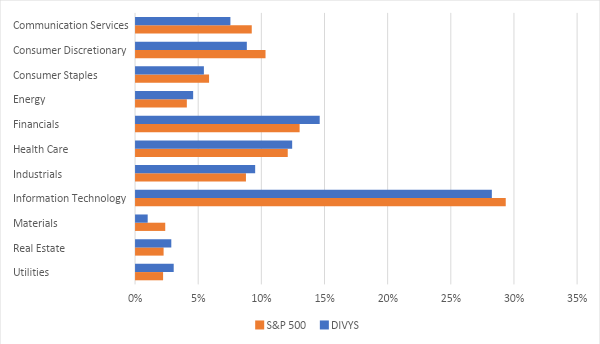

Figure 3: Q124 Portfolio Weightings vs S&P 500

Quick snapshot of Q1 Attribution:

- Average allocation to cash was flat at 1.7% as trading was primarily funded with existing positions.

- Yield on the portfolio as of 03/29/2024 was 2.03% and the beta was .80.

- The Dividend and Yield Strategy returned +9.55% gross /+9.42% net, which was +206bp and -+193bp ahead of the benchmark* return of +7.49%.

- Relative to the Nasdaq US Broad Dividend Achievers (DAATR), DIVYS was overweight communication services, technology, and consumer discretionary and underweight staples, financials, materials, industrials, and healthcare.

- Relative to the Nasdaq US Broad Dividend Achievers (DAATR), DIVYS outperformed in technology and communication services and underperformed in consumer staples and industrials.

- Top single-name contributors included NVDA, XLC, AMAT and TSMC.

- Top single-name detractors included NKE, AVGO, AAPL and PG.

- Relative to the S&P500, DIVYS was overweight financials, industrials and utilities and underweight technology, materials, and communication services. All over and underweights relative to the S&P500 are less than absolute 2% difference, highlighting the balanced risk profile in the portfolio.

- New positions added during the quarter: LEN, ABBV, AMGN, ROK

- Positions sold during the quarter: MDC, AJG, ABC, CSCO

- The 1Q outperformance was primarily the result of tactical moves made during 2023 that shifted the portfolio to a more balanced sector allocation from its previous defensive positioning.

- The DIVYS strategy continues to maintain a lower standard deviation vs benchmark*—one year standard deviation of 9.5% vs benchmark* of 9.7%.

As we look ahead, we believe our Dividend & Yield Strategy is finely tuned to leverage the unfolding economic landscape which, suggests a broadening economic expansion with supportive conditions for growth. The current economic conditions have created an ideal environment for our strategic approach to sector allocations. Over the last few quarters, we've methodically adjusted our allocations to achieve a more equilibrium-based distribution across sectors, subtly transitioning towards a somewhat more pro-cyclical posture from what was initially a more cautious positioning.

All information set forth herein is as of March 31,2024, unless otherwise noted. This email contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed in this email will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Hilton Capital Management, LLC (“HCM”) is a registered investment adviser with its principal place of business in the State of New York. For additional information about HCM, including fees and services, send for our Form ADV using the contact information herein. Please read the Form ADV carefully before you invest or send money. Past performance is no guarantee of future results. All information set forth in this email is estimated and unaudited.

*Dividend and Yield Benchmark = Nasdaq US Broad Dividend Achievers TR