HCM Insights

DIVYS Q2 24 Recap: Navigating Megatrend Titans

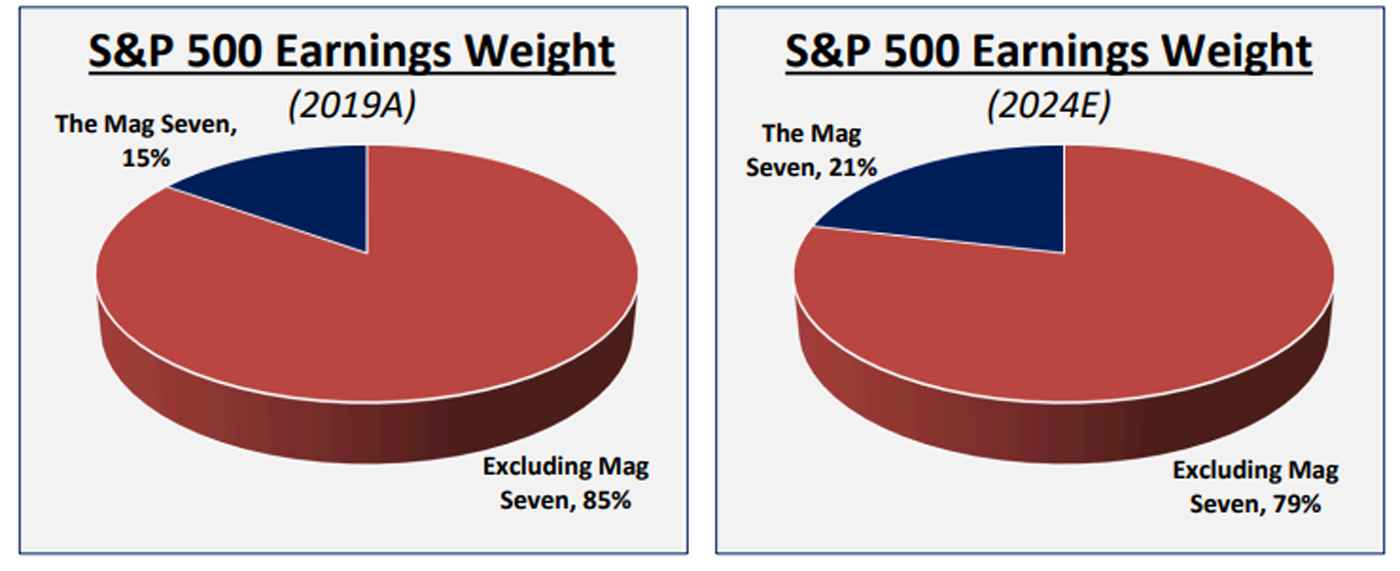

As we mark the 10th anniversary of Hilton's Dividend and Yield Strategy (DIVYS), we are both humbled by the trust you’ve placed in us and energized by the opportunities that lie ahead, reflecting on a decade of strategic outperformance, resilience through market cycles, and unwavering commitment to delivering value to our investors. With this, the portfolio decisively outperformed its benchmark, the Nasdaq US Broad Dividend Achievers Index, by 3.9% gross/ 3.7% net in Q2 2024. This outperformance was driven by the fund's prudent stock selections as well as continued favorable macroeconomic tailwinds. As a result, the portfolio's year-to-date performance has reached 14.7% gross/14.4% net, significantly exceeding the benchmark's return of 8.3%. Consequently, our stance remains that economic indicators support current market optimism given steady disinflation, healthy employment, and positive real GDP growth expectations. However, despite these positive sentiments, the market's underlying breadth is alarmingly narrow, with just a few mega-cap technology companies responsible for the vast majority of year-to-date gains. This is evidenced by the historically wide gap between the S&P 500 Market Index and Equal Weight Index YTD returns, which currently stands at a substantial 10.2% difference.

Against this backdrop, we maintain our view that a concentrated market rally benefits active managers, as demonstrated by the portfolio’s robust set of Q1 reports aided by a slew of impactful upward revisions to forward estimates. Nonetheless, DIVYS also benefited from broader market optimism surrounding AI, private credit, and GLP-1 trends as illustrated by the portfolio’s continued holdings in TSM, MSFT, AVGO, NVDA, ORCL, ARES, and APO, as well as the recent addition of LLY. Irrespective of these large-cap growth holdings, DIVYS generated a notable dividend yield of approximately 200 basis points, surpassing the S&P 500’s 125 basis point yield while matching the yield of our Broad Dividend Achievers Benchmark. Separately, we are pleased to have Michael O’Brien, CFA join our investment team in the second quarter as Hilton’s multi-asset analyst. Mr. O’Brien will lead the research efforts across our firm’s flagship Tactical Income and Dividend & Yield Strategies. Prior to Hilton, Mike was a sell-side equity analyst at Wolfe Research with previous experience at FTI Consulting’s turnaround & restructuring advisory practice.

Figure 1: “Magnificent 7” S&P 500 Earnings Weight

Figure 1: “Magnificent 7” S&P 500 Earnings Weight

Source: Bloomberg, Wolfe Research.

Ultimately, we believe DIVYS is well positioned to capture broader market megatrends while simultaneously set to benefit from a “higher for longer” climate through a lower volatility, higher return strategy. In such an environment, management teams are increasingly instituting or raising shareholder dividends as investors seek greater yield. This trend is exemplified by notable recent dividend initiations by Alphabet and Meta, as well as NVDA’s substantial dividend increase.

In 2Q 2024, our Dividend & Yield Strategy underwent significant strategic adjustments, demonstrating our proactive approach to both top down and bottoms up analyses. As always, our decisions to sell, reduce, and add positions were made with the goal of optimizing portfolio performance and upholding our investment philosophy centered on long-term value creation and income generation. Unlike many of our peers, we are macro-focused while concurrently centered on owning high-quality companies with widening competitive moats, durable balance sheets, and strong free cash flow generation at reasonable valuations. With this, our process is agnostic to higher yield versus higher dividend growth, however, we prefer both if possible!

Portfolio Adjustments

We made the decision to completely sell our holdings in Air Products & Chemicals (APD) due to several concerns that undermine the company’s potential for sustained growth and profitability in comparison to its peers, notably Linde (LIN). Moreover, continued delays in projects coupled with escalating capital expenditures introduced significant uncertainty regarding future free cash flow generation. After initially reallocating those funds into the S&P Materials Sector (XLB), we ultimately decided to allocate that capital to LyondellBasell Industries (LYB). We believe LYB presents an interesting situation given that management is undergoing a strategic review of the company’s European plants. We believe such action could structurally improve LYB’s long-term profitability and free-up capital to allocate back to shareholders.

Within Industrials, we initiated on BWX Technologies (BWXT), a leading supplier of nuclear components and fuel to the US government and commercial customers. We are compelled by the firm’s strong position in naval nuclear propulsion systems and consistent financial execution through solid revenue growth and margin expansion. On the Technology front, we continue to see material gains in our semiconductor holdings due to AI tailwinds, however, to limit concentration risk, we trimmed Taiwan Semi (TSM) and Applied Materials (AMAT) to maintain a 2% position for each respective holding.

Later in the quarter, we made several strategic adjustments within the Healthcare Sector. We exited our long-time position in Johnson & Johson (JNJ) given that we believe the ongoing talc litigation issue will continue to be a major headwind for the business. Despite its attractive yield and large weight to the bench, we see no “quick fix” to the company’s litigation woes, which, in our view, will persistently compress its valuation multiple. Additionally, we exited our position in Zimmer Biomet (ZBH) given our lack of confidence in management’s ability to efficiently allocate capital to accretive acquisitions. On the acquisition side, we initiated a position in Eli Lilly (LLY) in an effort to capitalize on GLP-1 trends as the company holds a sizable market position in the high-growth weight loss market. Moreover, we are impressed with management’s consistently high organic growth and return on invested capital, which are driven by LLY’s long tail of at-market drugs and its best-in class pipeline. Despite its at-first-glance high valuation, LLY’s PEG (forward P/E relative to EPS growth) is in-line with pharmaceutical peers.

Further into the quarter, we made tactical adjustments with the consumer space. We initiated on Phillip Morris (PM) and exited our stake in Nike (NKE). For Phillip Morris, we believe the company is in a unique position as an international tobacco market leader with a profitable double digit growth engine via smoke-free products, notably ZYN and IQOS. Following PM’s value-accretive acquisition of Swedish Match in 2023, PM is gaining market share in the majority of US States as ZYN is expected to drive double digit revenue and operating income growth through 2026. We are intrigued by this unique opportunity as it is rare to find a 5%+ dividend yielding business with solid EPS growth trading below its 10YR median valuation. Moreover, with Chevron Deference recently overturned by the United States Supreme Court, we are increasingly confident that ZYN will not be banned by the FDA. As for Nike (NKE), we sold our position due to the company’s continued inventory management issues, increased competition from emerging brands, and weak China sales. Nike’s direct-to-consumer strategy, while promising long-term, has caused friction with wholesale partners, which limits the business’ near-to-medium term upside potential. As such, we reallocated NKE’s capital to a consumer discretionary ETF (FDIS), which will serve as a placeholder until we find a more suitable single position to complement the existing portfolio.

As mentioned earlier, for Q2 2024, DIVYS outperformed its benchmark* by 385bp gross and 371bp net. As Figure 2 illustrates, the Dividend and Yield strategy outperformed consistently during the first six months of 2024.

Figure 2: Absolute & Relative Performers vs Benchmark Q2 24

Figure 2: Absolute & Relative Performers vs Benchmark Q2 24

Source: Bloomberg.

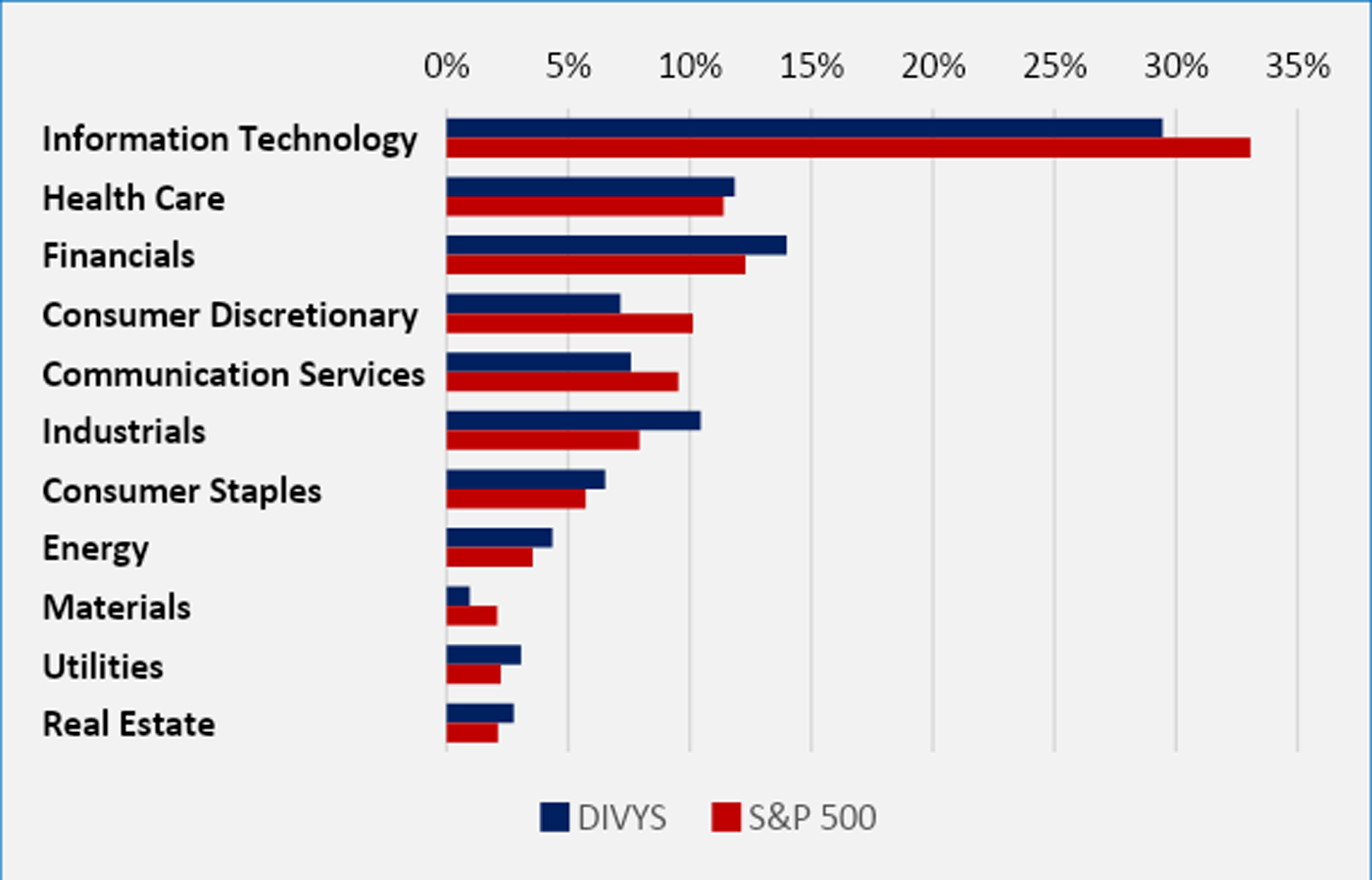

Figure 3: Q2 24 Portfolio Weightings vs S&P 500

Figure 3: Q2 24 Portfolio Weightings vs S&P 500

Quick snapshot of Q2 Attribution:

- Average allocation to cash was up slightly at 1.8%, however, new positions were primarily funded with existing positions.

- Yield on the portfolio as of 06/30/2024 was 1.96% and the 1 year Beta was .94.

- The Dividend and Yield Strategy returned +4.53% gross /+4.39% net, which was +385 bp and +371 bp ahead of the benchmark* return of +.68%.

- Relative to the Nasdaq US Broad Dividend Achievers (DAATR), DIVYS was overweight communication services, technology, consumer discretionary, and real estate and underweight staples, financials, materials, industrials, and healthcare.

- Relative to the Nasdaq US Broad Dividend Achievers (DAATR), DIVYS outperformed in Communication Services, Consumer Discretionary, Energy, Financials, Healthcare, Industrials, Information Technology, Materials, Real Estate and Utilities for the quarter.

- Top single-name contributors included NVDA, TSM, NTAP, and AZN

- Top single-name detractors included ZBH, LEN, DRI, and APD.

- Relative to the S&P500, DIVYS was overweight Financials, Healthcare, Industrials, Consumer Staples, and Utilities and underweight Information Technology, Consumer Discretionary, and Communication Services.

- New positions added during the quarter: LYB, PM, LLY, BWXT.

- Positions sold during the quarter: JNJ, ZBH, NKE, XLB, APD.

- The 2Q outperformance was primarily the result of tactical moves made during 2023 / 1Q 2024 that shifted the portfolio to a more a broader megatrend focused portfolio from a previously more defensive position.

- The DIVYS strategy continues to maintain a low standard deviation—one-year standard deviation of 9.5% vs benchmark* of 9.3% and S&P 500 of 11.2%.

Looking to the future, we are confident our Dividend & Yield Strategy is well-positioned to capitalize on the evolving economic environment, which points to widening economic expansion supported by conditions conductive to growth. The current economic landscape has fostered an optimal setting for our strategic sector allocation approach, as evidenced by this year’s performance. Over recent quarters, we have systematically adjusted our sector weights to achieve a more balanced distribution, gradually shifting towards a modestly more pro-cyclical stance that adequately captures broader megatrend tailwinds from an initially more defensive allocation.

All information set forth herein is as of June 30th, 2024, unless otherwise noted. This letter contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed herein will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Hilton Capital Management, LLC (“HCM”) is a registered investment adviser with its principal place of business in the State of New York. For additional information about HCM, including fees and services, send for our Form ADV using the contact information herein. Please read the Form ADV carefully before you invest or send money. Past performance is no guarantee of future results. All information set forth herein is estimated and unaudited.

*Dividend and Yield Benchmark = Nasdaq US Broad Dividend Achievers TR