HCM Insights

From Concentration to Constellation: A Quarter of Widening Opportunities

The third quarter of 2024 marked a significant shift from the previous quarter, characterized most notably by a broadening market participation across sectors. Within a span of just three months, the market's narrative shifted dramatically. The focus pivoted from a prevailing trend of disinflation, bullish earnings forecasts, and expectations of sustained high interest rates to a more complex landscape. This new scenario features softening employment data juxtaposed with dovish signals from the Federal Reserve. While many market participants debate the likelihood of a 'hard' versus 'soft' landing, our analysis suggests a more nuanced outcome. We anticipate heightened market volatility characterized by both exogenous and endogenous factors, such as the upcoming election, geopolitical tension, employment, and interest rates. Therefore, while overarching economic indicators continue to suggest a soft landing scenario, recent employment data have heighted the probability of a ‘bumpy’ landing as we enter the new year.

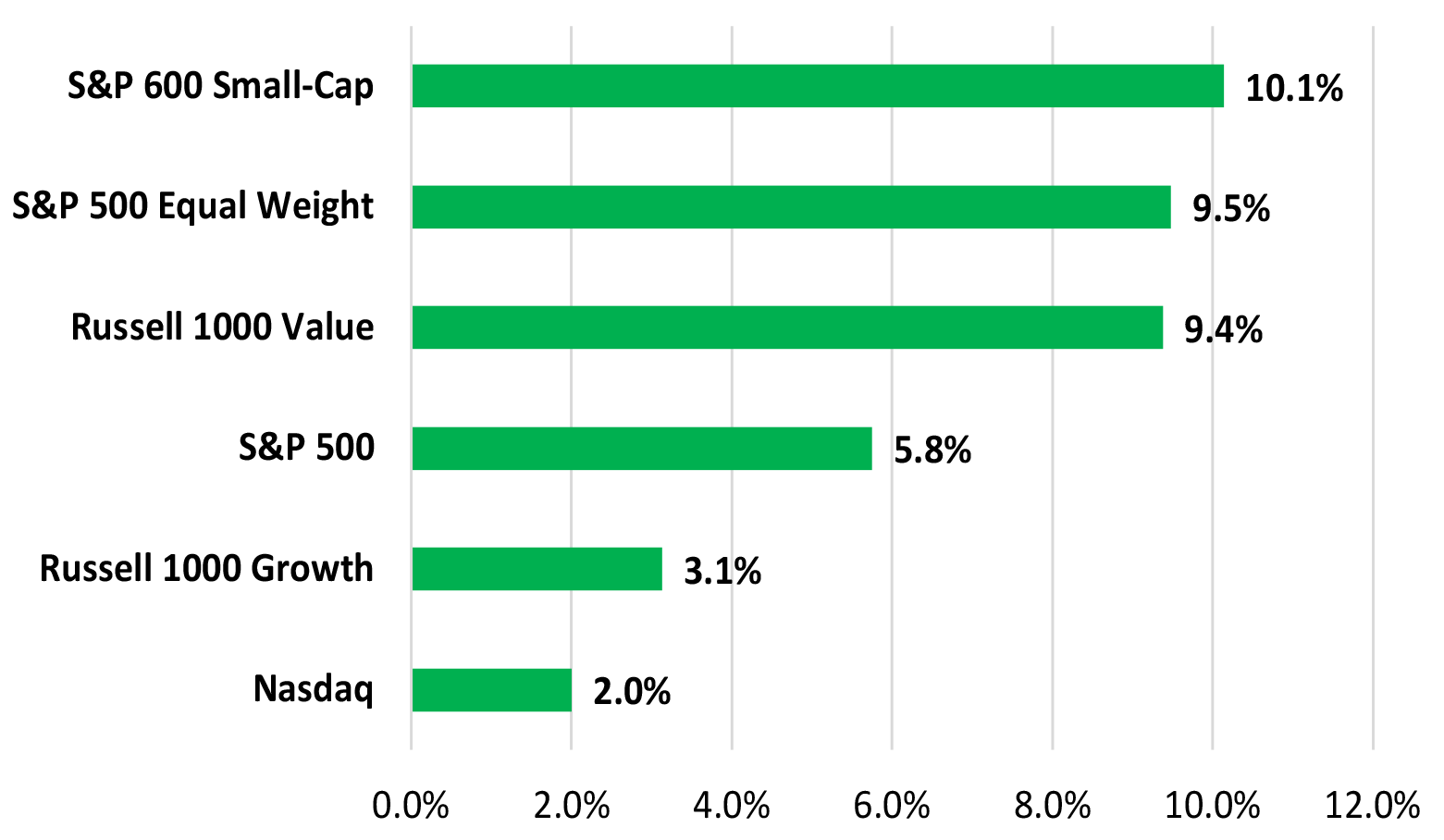

Despite a mixed-signal macro environment, the market’s breadth dramatically expanded as indicated by the S&P 500 Equal Weight outperforming its market-weight counterpart by ~375 basis points for the quarter. Furthermore, the shift in market sentiment regarding Federal Reserve policy reversed many of the trends observed in the previous quarter, notably the outperformance of small-cap stocks over large-caps, value over growth, and dividend payers over non-payers.

Figure 1: Q3 Equity Indices Total Return

Figure 1: Q3 Equity Indices Total Return

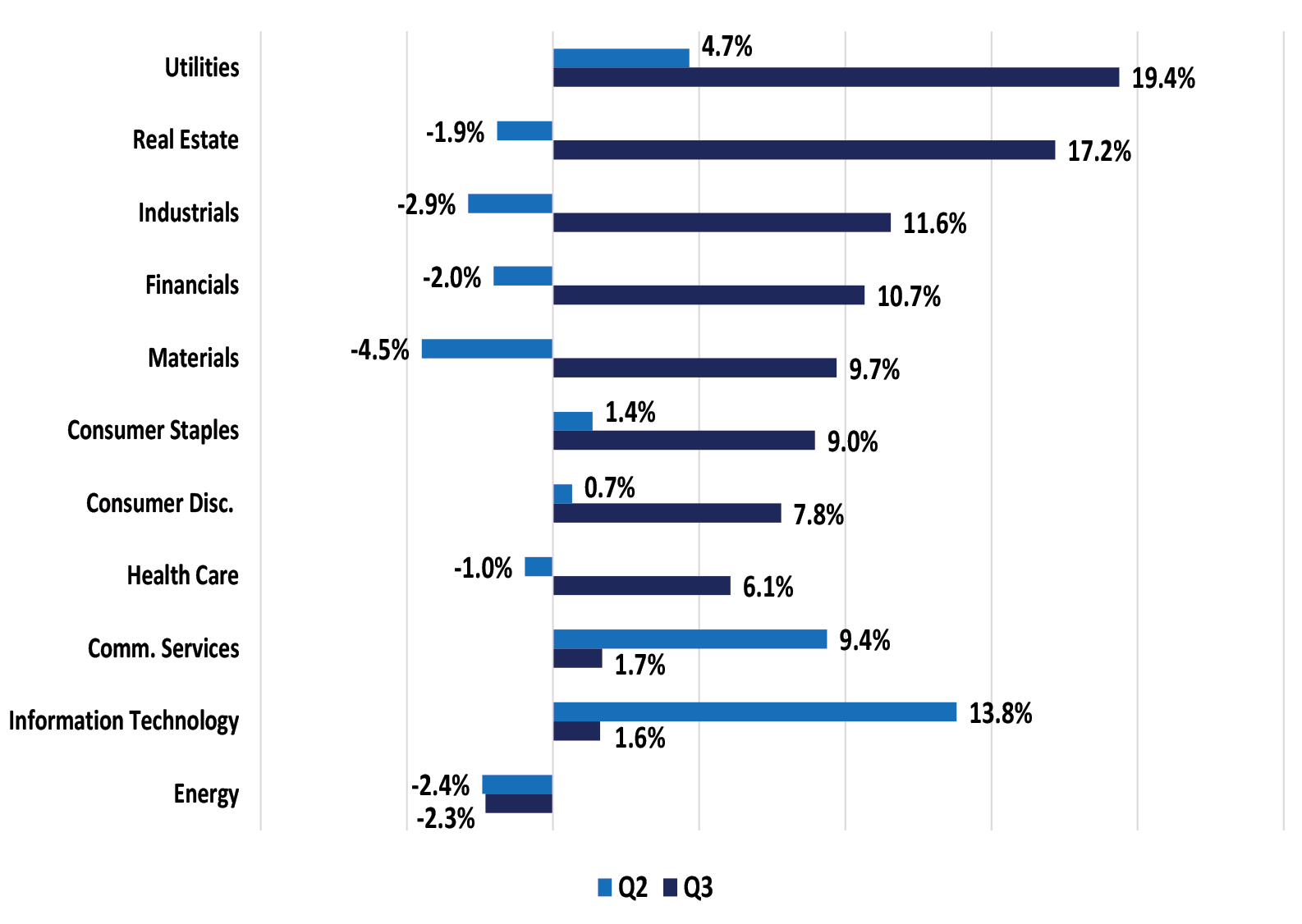

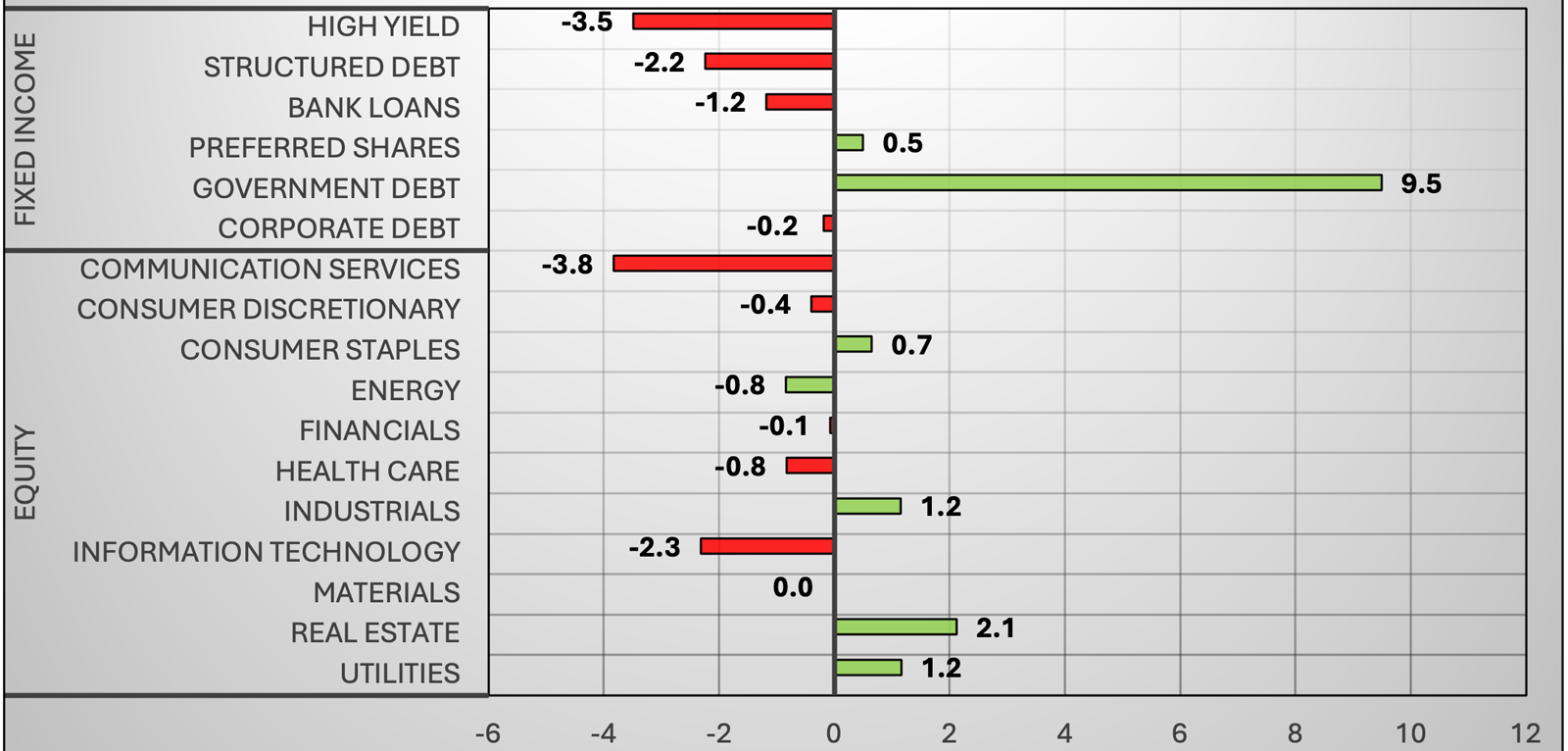

Although all major U.S. indices posted gains for the quarter, a confluence of factors—including declining interest rates, elevated valuations, and growing skepticism about the return on investment in artificial intelligence—led to a significant reversal in sector performance. Notably, many sectors that lagged in the previous quarter emerged as top performers this quarter, underscoring the market's rapid shift in sentiment and capital allocation. As shown below, Figure 2 illustrates a dramatic reversal in sector performance. Utilities, Real Estate, Industrials, Financials, and Materials, which were all in negative / underperforming territory last quarter, rebounded strongly to post double-digit gains in the current quarter.

Figure 2: Q3 v. Q2 S&P 500 Sector Total Return

Figure 2: Q3 v. Q2 S&P 500 Sector Total Return

In a broader context, the market has clearly shifted its perspective following a series of softening employment reports and decelerating inflation data. The prevailing sentiment has reverted to interpreting negative economic indicators at face value, rather than as potential catalysts for accommodative monetary policy. Nevertheless, we maintain our conviction that the Federal Reserve has pivoted its focus towards its employment mandate, considering its battle against inflation largely won. This shift in priorities was notably evident in Chair Powell's dovish rhetoric at the Jackson Hole symposium and the FOMC’s subsequent 50 basis point Federal Funds Rate cut in September.

Market Tailwinds During 3Q:

- Disinflation: Core PCE at ~2.6%.

- Easing Financial Conditions: 2YR down ~111bps / 10YR down ~62bps.

- Rising 3Q/4Q and FY ’25 Earnings Expectations.

- Stronger Revised Savings Ratio: ~5% v. <3.5% pre-revision.

- Falling U.S. Bond Volatility.

- Weakening USD.

- Narrowing US Corp High Yield – 10YR spreads.

- Expanding Market Breadth: S&P 500 Equal Weight Outperforms.

- 3Q24 GDP at +3.0%.

Market Headwinds During 3Q:

- Weakening Employment: Sahm Rule Triggered / Lower US Job Openings.

- Concerns on Return on Investment in AI.

- Greater Equity Volatility: VIX up >3pts.

- Heightened Equity Valuations.

- Geopolitical Tensions in Europe and Middle East.

- U.S. Election Uncertainty.

Tactical Income Strategy 3Q24 Review:

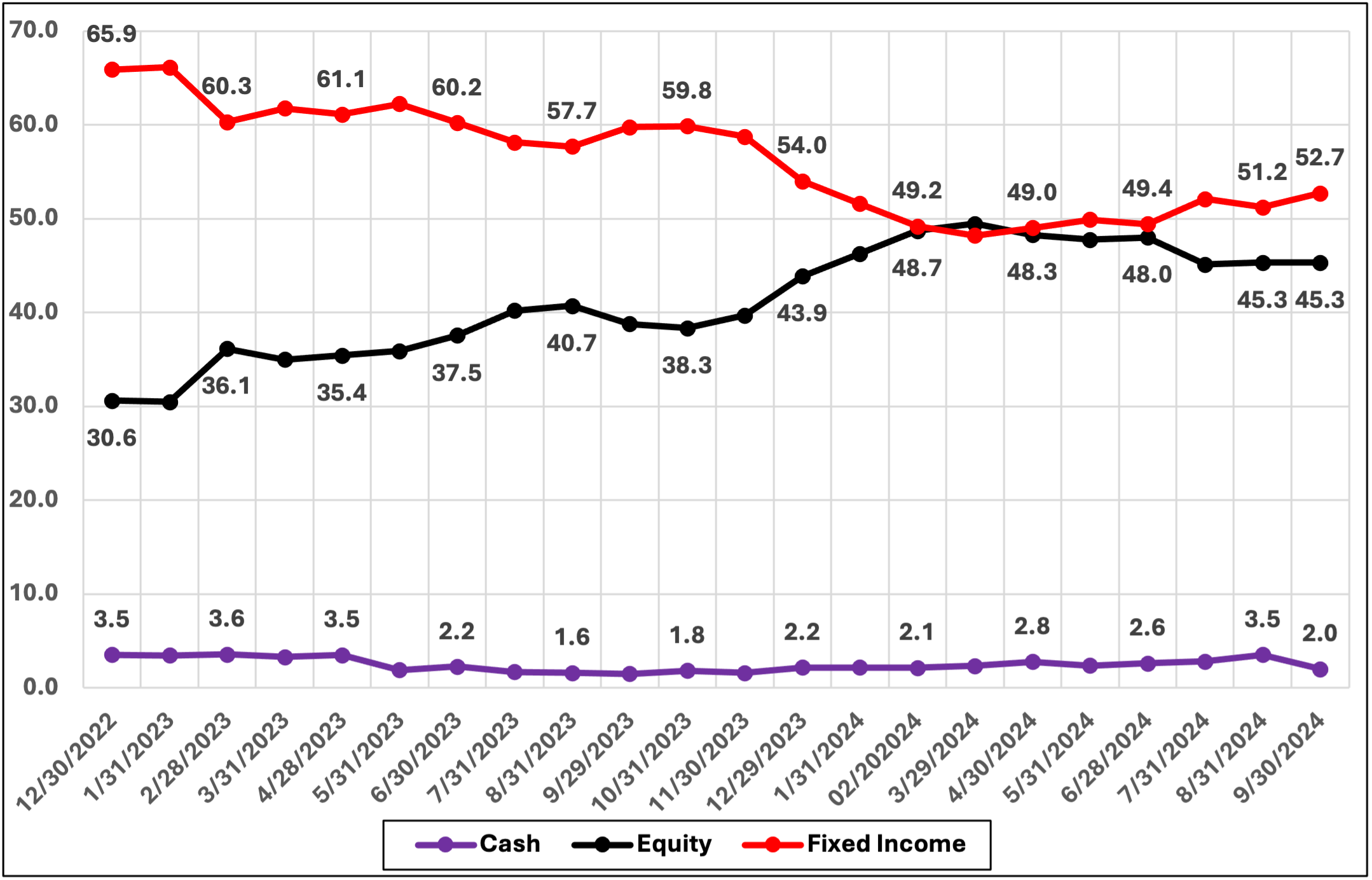

During the third quarter, the Hilton Capital Investment Committee maintained a prudent level of risk in the portfolio, making small, yet impactful, allocation adjustments to reflect a changing market environment. Consequently, the asset allocation at the end of the third quarter was adjusted to approximately 52.7% fixed income (up from 49.4%), 45.3% equities (down from 48%), and 2% cash (down from 2.6%). Following a strategic increase in portfolio risk during the first quarter, the Committee decided to capitalize on the gains from higher-beta technology stocks and reallocate capital back to fixed income securities. This move aimed to balance the portfolio ahead of heighted market volatility.

Figure 3: Tactical Income asset allocations

January 1, 2023 – September 30, 2024

Figure 3: Tactical Income asset allocations

The following specific asset adjustments were made to the portfolio during the quarter.

Fixed Income: The Investment Committee strategically established and subsequently expanded its position in the Simplify MBS ETF (MTBA). This ETF specializes in recently issued, higher-yielding mortgage-backed securities (MBS) from premier government-sponsored entities: the Government National Mortgage Association, Federal National Mortgage Association, and Federal Home Loan Mortgage Corporation. This tactical allocation provides the portfolio with a distinctive edge in anticipation of a potential rate-cutting cycle. The MTBA position offers enhanced yield coupled with improved price stability, effectively positioning the portfolio to navigate the challenges of a volatile interest rate environment

As the quarter progressed, the Investment Committee made a strategic decision to divest the portfolio's BBB-rated Collateralized Loan Obligation (JBBB), Senior Loan (BKLN), and short-term high-yield (SHYG) positions and simultaneously increased its allocation to Short-Term Treasuries. This adjustment was implemented to reduce the portfolio's exposure to high-yield corporate credit considering growing macroeconomic uncertainties. Separately, we added to our MBS ETF (MBB) in late 3Q to take advantage of relatively attractive mortgage spreads versus corporates.

Figure 4: Tactical Income Q324 sector allocation changes

Figure 4: Tactical Income Q324 sector allocation changes

Equities: On the equity side of the portfolio, the Investment Committee initiated on a few high-quality large-cap international stocks, which provide the portfolio with increased geographic diversification and exposure to high-quality compounders. With this, the Committee initiated on Schneider Electric (SBGSY US ADR), Itochu Corp. (ITOCHY US ADR) and 3i Group (TGOPY US ADR) throughout the quarter. For Schneider Electric, the Investment Committee was compelled by the Company’s well-established market share in industrial electrification and digitalization products, mostly notably data-center switchboards. As for Itochu Corp., the team believed that ITOCHY’s broad exposure to international markets, notably textiles, manufacturing, technology, and energy, mixed with a long-term history of compounding book value at a low-double digit rate would be a great fit for the portfolio’s low-beta value-oriented strategy. Lastly, 3i Group is an under-the-radar high quality European private equity conglomerate with over 70 years of operating history and ~75% proprietary long-term capital. The Committee initiated on 3i to take advantage of the company’s largest long-term holding, Action, which is Europe’s fastest growing retail chain. Based on their analysis, 3i trades at a substantial discount to fair value mixed with a compelling history of double-digit dividend growth.

Beyond the portfolio's newly established international positions, the Investment Committee implemented several strategic equity adjustments throughout the quarter. Early in the period, the Committee divested its position in Becton Dickinson (BDX) after years of holding, citing concerns about management's ability to streamline the company's complex portfolio. Simultaneously, the Committee initiated a position in Analog Devices (ADI), anticipating benefits from its recent Maxim Integrated Products acquisition and the upcoming iPhone refresh cycle, which we believe positions ADI well for the expected cyclical recovery.

Separately, in response to attractive valuations and anticipation of lower interest rates and increased housing demand, the Committee expanded its real estate holdings through investments in Public Storage (PSA), AvalonBay Communities (AVB), Independence Realty Trust (IRT), and Prologis (PLD). Furthermore, the Committee strategically adjusted its semiconductor exposure. It reduced its position in Taiwan Semiconductor Manufacturing Company (TSM) and fully divested from Applied Materials (AMAT), primarily due to escalating U.S.-China tensions and concerns about stretched valuations in the sector.

As for large-cap technology, the Committee ultimately decided to exit the portfolio’s position in Alphabet (GOOGL) and trimmed its positions in Microsoft (MSFT), Apple (AAPL) and S&P Communications (XLC). With growing anti-trust headline risk, concerns surrounding AI-related CapEx spend, and elevated valuations, the team believed that the ‘Magnificent 7’ would underperform the broader market. Presently, the Committee increased the portfolio’s stake in its Nasdaq Covered Call position (JEPQ) to lower the beta and increase the yield without significantly limiting exposure to large-cap technology.

Moreover, the Investment Committee strategically continued to adjust the portfolio's composition, reducing positions in Tractor Supply (TSCO) and TJX Co. (TJX), while fully divesting from Visa (V). These moves were executed to redeploy capital into opportunities offering higher yields and more defensive characteristics. Consequently, the strategy increased its stakes in Walmart (WMT), S&P Utilities (XLU), American Healthcare REIT (AHR), and Bank of America (BAC). The Committee believes these selections are well-positioned to capitalize on a declining interest rate environment without assuming undue beta risk. This reallocation aims to enhance portfolio resilience while maintaining potential for growth in the anticipated economic climate.

Within the healthcare sector, the Committee strategically exited its position in Novo-Nordisk (NVO US ADR) after realizing substantial gains from the company's successful GLP-1 related products. This decision was driven by the team's assessment that ongoing pricing pressures, capacity limitations, and increasing regulatory scrutiny could potentially impact Novo-Nordisk's performance relative to competitors, particularly Eli Lilly (LLY). Concurrently, the proceeds from the NVO sale were redeployed into Quest Diagnostics (DGX), aiming to leverage the company's dominant and expanding market share in the testing and diagnostics industry. The Investment Committee views Quest Diagnostics' valuation as particularly attractive, given its defensive growth characteristics. This reallocation not only aligns with the strategy's strategic objectives but also enhances the portfolios overall yield profile.

As the quarter drew to a close, the investment team executed a few more strategic moves to enhance the portfolio's positioning. The team initiated positions in NetApp (NTAP) and General Dynamics (GD), while also increasing its stake in Alerian MLP (AMLP). NetApp's addition was driven by its commanding position in cloud storage and data management services. The Investment Committee anticipates continued growth in this sector, particularly as data becomes increasingly critical for large-language models and AI applications. The investment in General Dynamics capitalizes on the company's strong market position across multiple sectors. GD's naval division, which forms a duopoly with Huntington Ingalls in vessel production, stands out as the lead contractor for the United States' Virginia-class nuclear submarines. This, combined with GD's dominant presence in marine and combat systems and its leadership in the private jet market through its Gulfstream division, presents a compelling opportunity.

Lastly, the increased allocation to Alerian MLP reflects the team's bullish outlook on energy supply infrastructure. The Investment Committee views MLPs as an attractive yield play, further diversifying the portfolio's income streams while capitalizing on robust energy production and growing demand.

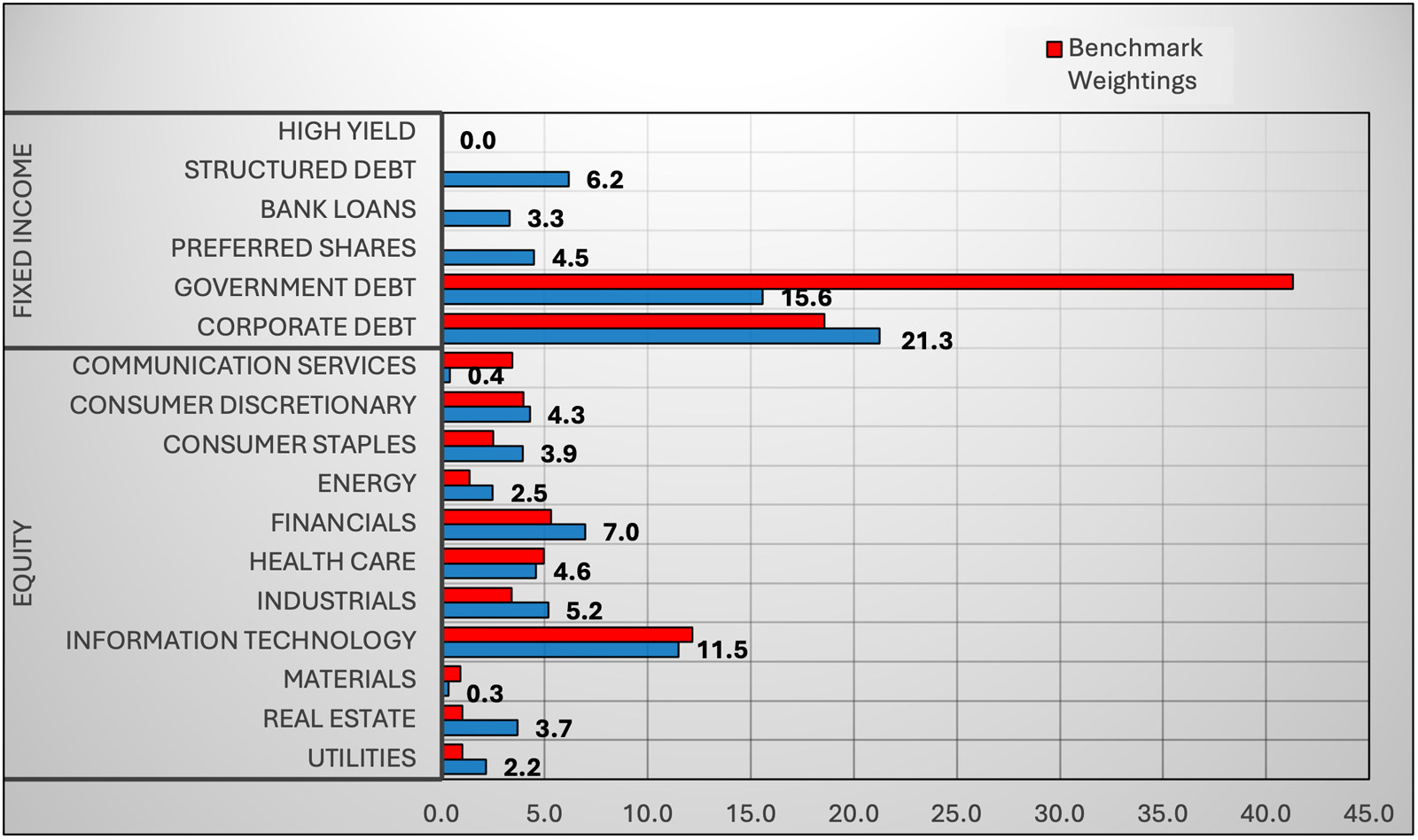

Figure 5: Tactical Income Sector Weights vs Benchmark*

Figure 5: Tactical Income Sector Weights vs Benchmark*

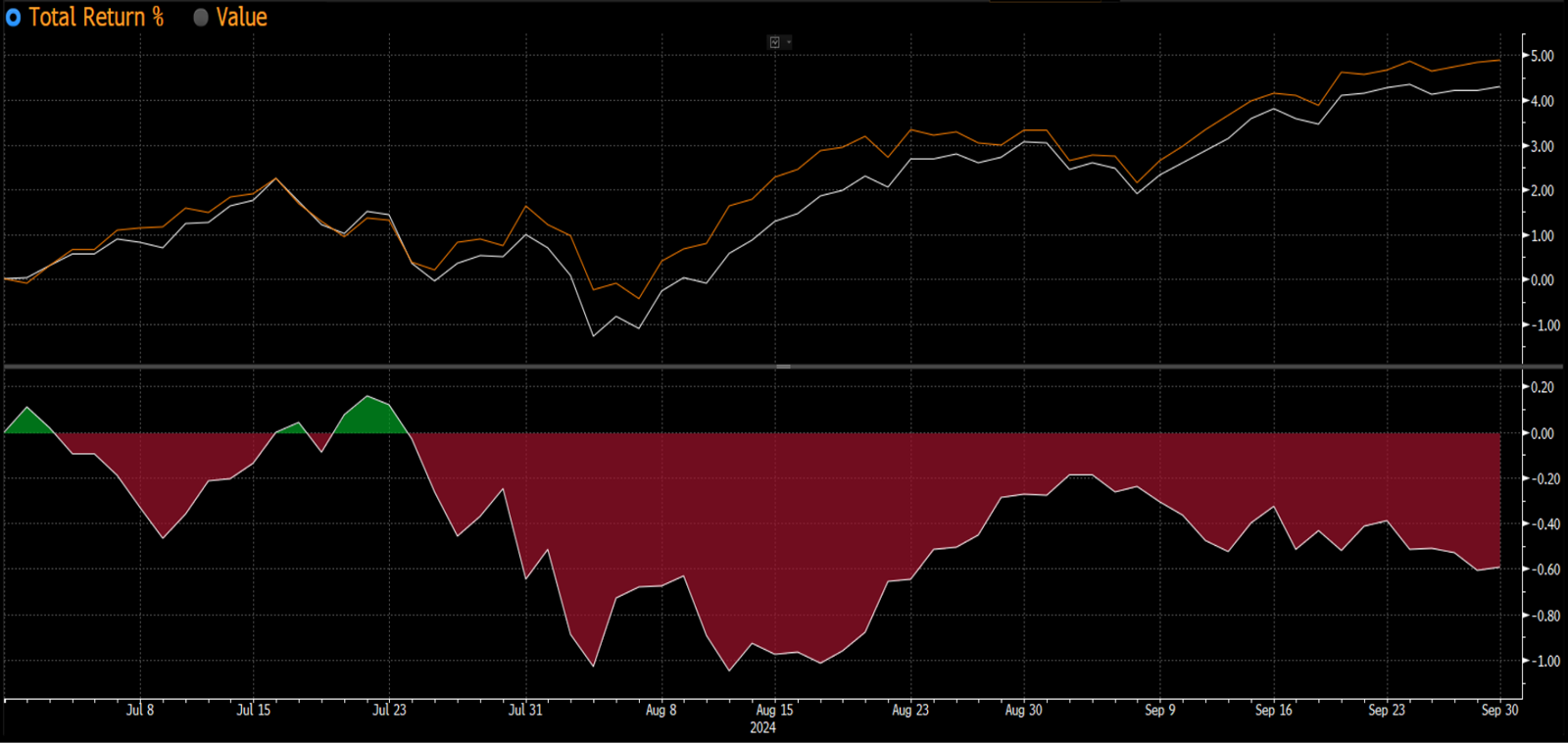

Performance: The Hilton Tactical Income Strategy demonstrated solid performance in the third quarter of 2024, delivering a return of 4.3% gross / 4.2% net. While this performance was commendable, it modestly trailed the benchmark* return of 4.9% by 57 basis points gross / 67 basis points net, as illustrated in Figure 6. Year to date the portfolio generated an impressive 11.81% gross / 11.4% net as shown in Figure 7.

Figure 6: Tactical Income Absolute and Relative Performance vs Benchmark* Q324

Figure 6: Tactical Income Absolute and Relative Performance vs Benchmark* Q324

Figure 7: Tactical Income Absolute and Relative Performance vs Benchmark* YTD

Figure 7: Tactical Income Absolute and Relative Performance vs Benchmark* YTD

In previous communications, we highlighted our concerns that our primary benchmark no longer accurately reflects the Hilton Tactical Income Strategy. This is primarily due to its 40% allocation to the higher beta, technology-heavy S&P 500. Consequently, we find that the Morningstar Moderately Conservative Index serves as a more suitable benchmark for our strategy, given its focus on lower-beta, higher-yielding equity holdings. Against this secondary benchmark, the Hilton Tactical Income Strategy delivered an impressive year-to-date outperformance of 2.42% gross / 2.02% net. However, during the third quarter, the strategy underperformed by 2.02% gross / 2.12% net. In terms of asset class contributions for the quarter, equities added 2.4% to the total return, while fixed income contributed 1.9%.

Correspondingly, The Hilton Tactical Income Strategy remains steadfast in its primary objective of generating income, with capital appreciation serving as a secondary goal. This focus is clearly reflected in the portfolio’s performance metrics for the quarter. As of the period's end, the strategy boasted an impressive indicated yield of 4.20%, significantly outpacing both our benchmarks. This yield stands in stark contrast to the 2.96% offered by our primary benchmark.

Quick snapshot of Q3 Attribution

- Average Asset Allocation during Q324: 3.2% Cash, 45.5% Equity, 51.3% Fixed Income

- Yield on the portfolio as of 09/30/2024 was 4.2%

- The Hilton Tactical Income Composite Q3 returned 4.3% gross / 4.2% net and modestly trailed the benchmark* return of 4.9% by 57 basis points gross / 67 basis points net.

- The Q3 underperformance was primarily a result of more lower-quality / deep-value outperformance relative to our higher-quality / defensive growth oriented equity positions and by maintaining a relatively shorter duration.

- The equity sector contribution to return was +5.59% which was 30bp behind the benchmark*, however, the strategy remained underweight Communication Services and overweight Consumer Staples, Financials, Real Estate, and Energy. All other Sectors were within +/- 100 bps of the benchmark*.

- There were no significant contributors or detractors related to the contribution to return of each sector.

- Fixed Income contributed +354bp which was -63bp behind the benchmark*, notably due to the portfolio’s shorter duration relative to the benchmark*.

- The average duration of the fixed income portfolio is 3.23 which is roughly in-line with duration of the benchmark. The average credit rating is A.

Outlook:

The Hilton Investment Committee remains committed to its proven hybrid investment strategy, seamlessly blending macro-economic insights with rigorous company-specific analysis. This nuanced approach has consistently demonstrated its efficacy in navigating complex market conditions, allowing the team to adeptly respond to:

- Evolving economic indicators

- Shifts in Federal Reserve policy

- Company-specific developments and opportunities

By maintaining this balanced perspective, the Committee continues to position the portfolio to seek to capitalize on emerging trends while mitigating potential risks. This dynamic methodology enables the team to make informed, timely decisions that align with both short-term market movements and long-term investment objectives.

The Federal Reserve's recent initiation of its cutting cycle, marked by a significant 50 basis point reduction, signals a pivotal shift in monetary policy. The Investment Committee's analysis suggests that the Fed will prioritize its employment mandate over inflation concerns, given that Core PCE remains at a manageable 2.6%. While acknowledging signs of softening in the labor market, particularly evident in declining job openings, the Committee discerns no immediate indicators of an impending recession. Recent employment data has surpassed expectations, and the potential for a "Fed Put" provides an additional layer of economic support. These factors collectively justify maintaining the current asset allocation within the portfolio.

It's important to note, however, that the Committee maintains a measured stance regarding short-term market directionality. The confluence of both endogenous and exogenous factors is likely to usher in a period of heightened market volatility. We believe the portfolio's current composition is strategically designed to navigate and potentially capitalize on these anticipated fluctuations. This nuanced outlook underscores the Committee's commitment to a balanced, risk-aware approach. By maintaining flexibility and vigilance, we believe the portfolio is well-positioned to adapt to evolving market conditions while seeking to optimize risk-adjusted returns for our investors. As we move forward, this time-tested approach will remain central to our investment philosophy, ensuring that we remain agile and well-positioned to deliver value in an ever-changing financial landscape.

All information set forth herein is as of September 30th, 2024, unless otherwise noted. This letter contains general information that is not suitable for everyone. The information contained herein should not be construed as personalized investment advice. There is no guarantee that the views and opinions expressed herein will come to pass. Investing in the stock market involves gains and losses and may not be suitable for all investors. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Hilton Capital Management, LLC (“HCM”) is a registered investment adviser with its principal place of business in the State of New York. For additional information about HCM, including fees and services, send for our Form ADV using the contact information herein. Please read the Form ADV carefully before you invest or send money. Past performance is no guarantee of future results. All information set forth herein is estimated and unaudited.

*Tactical Income Benchmark = 40% SPX TR Index / 60% Bloomberg Intermediate US Govt/Credit TR Index Value Unhedged. Please see the Tactical Income Factsheet which contains full performance information as well as relevant legal and regulatory disclaimers.