HCM Insights

Resilience Rewarded: Delivering Strong Results in a Dichotomous Market Environment

Hilton’s Tactical Income Strategy demonstrated resilience and efficacy throughout 2024, navigating a complex market landscape characterized by rapidly changing narratives. The year was defined by a compelling dichotomy: the continued dominance of the “Magnificent 7” tech giants versus an emerging trend towards broader market participation. Despite these conflicting forces, the Investment Committee’s approach proved adept at capitalizing on opportunities while mitigating risks to deliver robust performance amidst the market’s push and pull dynamics. As such, the strategy demonstrated exceptional agility and foresight in 2024, leveraging its multifaceted approach to deliver an attractive risk-adjusted return. The portfolio’s success was rooted in the team’s ability to:

- Capitalize on macroeconomic trends through a comprehensive top-down analysis.

- Identify and exploit thematic opportunities in artificial intelligence, GLP-1 therapeutics, and private credit markets.

- Employ rigorous bottom-up analysis to uncover idiosyncratic compounders, enhancing the portfolio’s return.

This blend of macro insights, thematic investing, and fundamental research enabled the strategy to achieve risk-adjusted outcomes with a keen focus on maximizing total return for investors. As we look ahead to 2025, we anticipate another complex market environment characterized by persistent volatility. This landscape is shaped by two key factors: the Federal Reserve’s steadfast “Higher for Longer” policy stance and the potential moderation of AI-related Capital expenditures that have bolstered the market’s soft-landing narrative in recent years. While broad economic indicators continue to signal robust earnings growth potential for large-cap equities, several countervailing forces introduce uncertainty and therefore warrant increased focus by the investment team. Recent employment data trends, coupled with housing affordability and supply constraints, suggest potential headwinds for consumer spending and economic growth. Furthermore, an increased likelihood of deceleration in AI-driven CapEx could temper the tech sector’s outsized contribution to market performance.

These factors collectively suggest that fiscal 2025 may present a more nuanced and challenging investment landscape compared to the relative clarity of recent years. As such, the Investment Committee is prepared for a market environment that demands heightened vigilance and adaptability in the face of evolving economic dynamics.

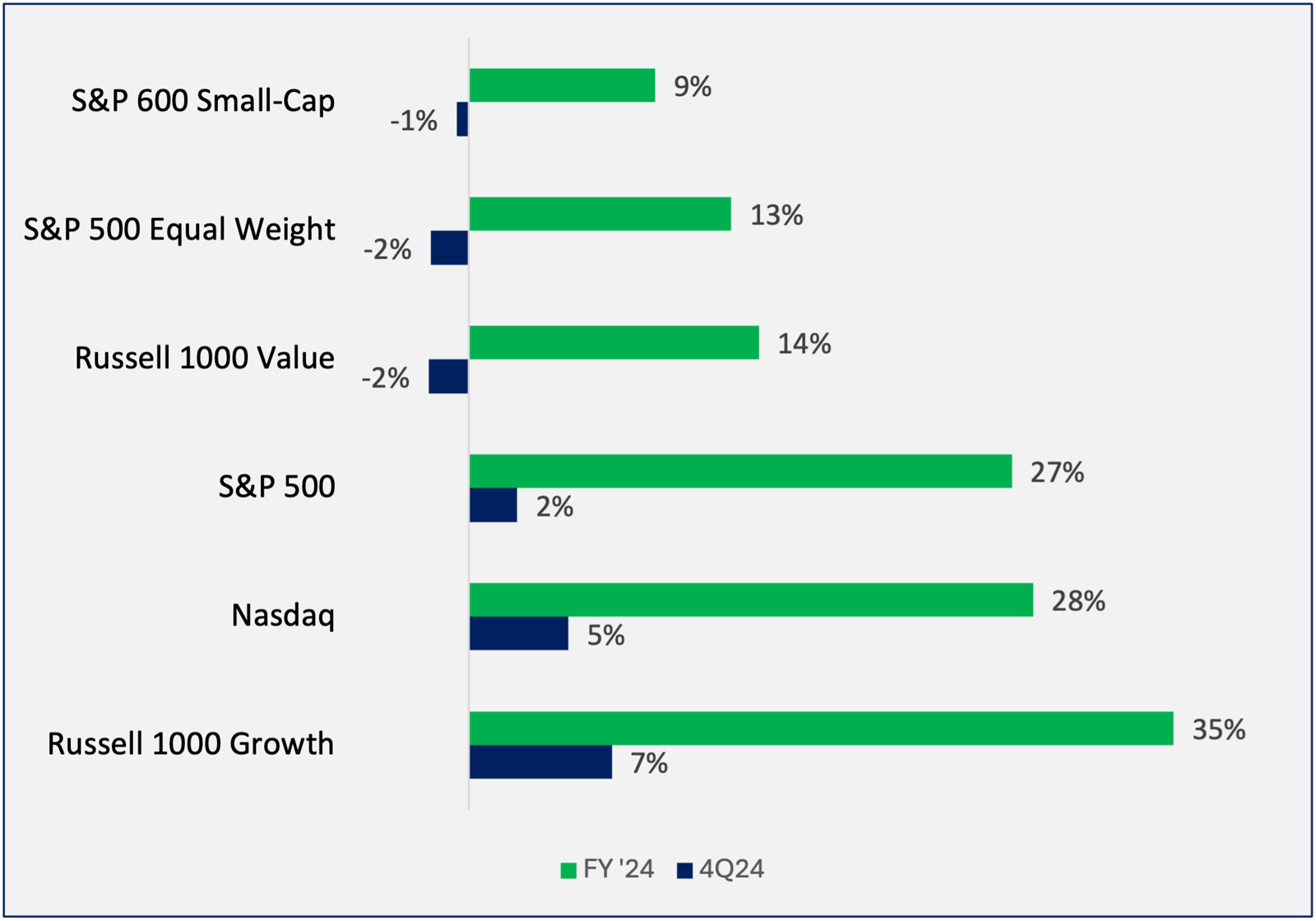

As shown on in Figure 1, all U.S. equity indices demonstrated positive performance in 2024, however, the performance landscape was far from uniform. We believe that a combination of factors – notably declining interest rates, sustained enthusiasm for artificial intelligence, and robust government spending – catalyzed a significant outperformance of growth equities relative to their value and small-cap counterparts.

Figure 1: 4Q v. FY 2024 Equity Indices Total Return

Figure 1: 4Q v. FY 2024 Equity Indices Total Return

Source: Bloomberg

In a striking display of market agility, many sectors that had lagged in the third quarter of 2024 staged impressive comebacks, emerging as top performers in the final quarter of the year. This rapid shift in sentiment and capital allocation underscores the market’s capability for swift rotation. Our Investment Committee observed that, despite potential employment challenges, the Federal Reserve (the Fed) has sharpened its focus on curbing inflation once again. Nevertheless, the Investment Committee anticipates that the Fed could swiftly revert to accommodative monetary policy, effectively, providing the market with a ‘Fed Put’ if economic conditions deteriorate. Interestingly, 10-year Treasury rates have recently surged above 4.75%, while market consensus is pricing in only one 25 basis point rate cuts for 2025. We view this as overly hawkish, given the continued moderation in inflation and potential softness emerging in employment data. Consequently, our outlook for fiscal year 2025 remains constructive on both equity and fixed income markets, albeit with increased volatility.

Market Tailwinds During 4Q:

- AI Optimism.

- Deregulation Expectations.

- Rising Small Business Optimism.

- Narrowing US Corp High Yield – 10YR spreads.

- 3Q24 Nominal GDP at ~5.0%.

- Cooling Geopolitical Tensions.

Market Headwinds During 4Q:

- Inflation: Core PCE at ~2.8%

- Tightening Financial conditions: 2YR up ~60 bps / 10YR up ~80bps

- Greater Equity Volatility: VIX up >2pts.

- Heightened Equity Valuations.

- Stronger USD (DXY up ~10% in 4Q24).

- Potential Tariff Exposure.

Tactical Income Strategy 4Q24 Review:

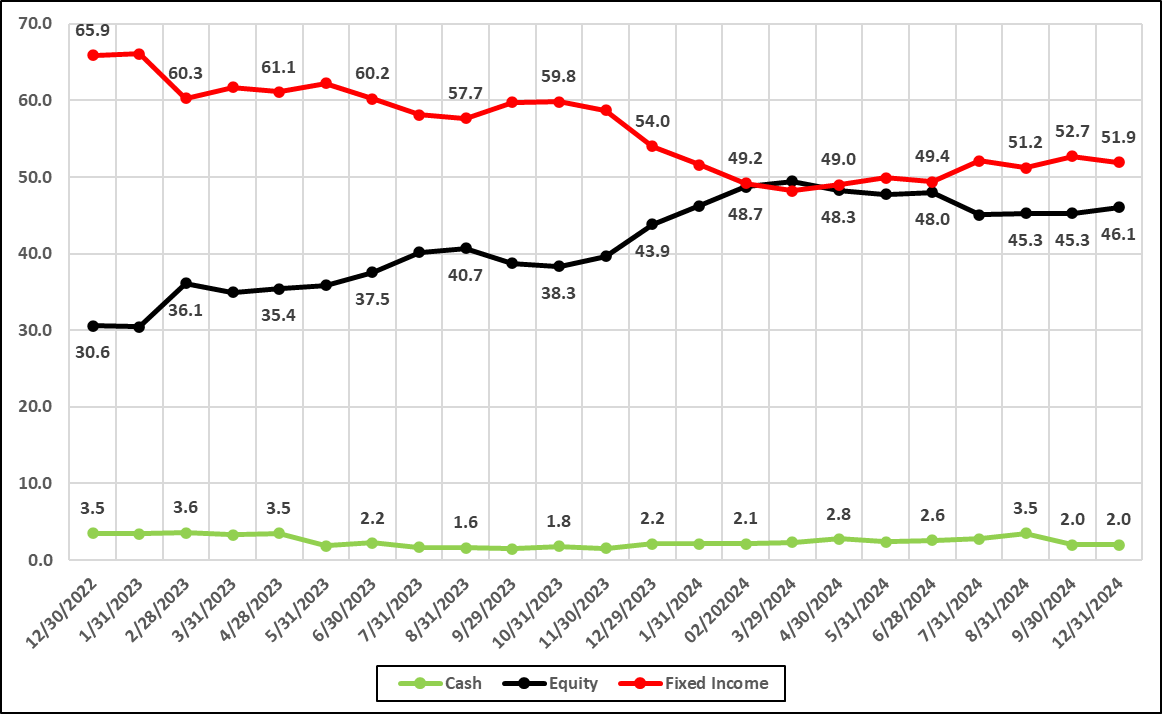

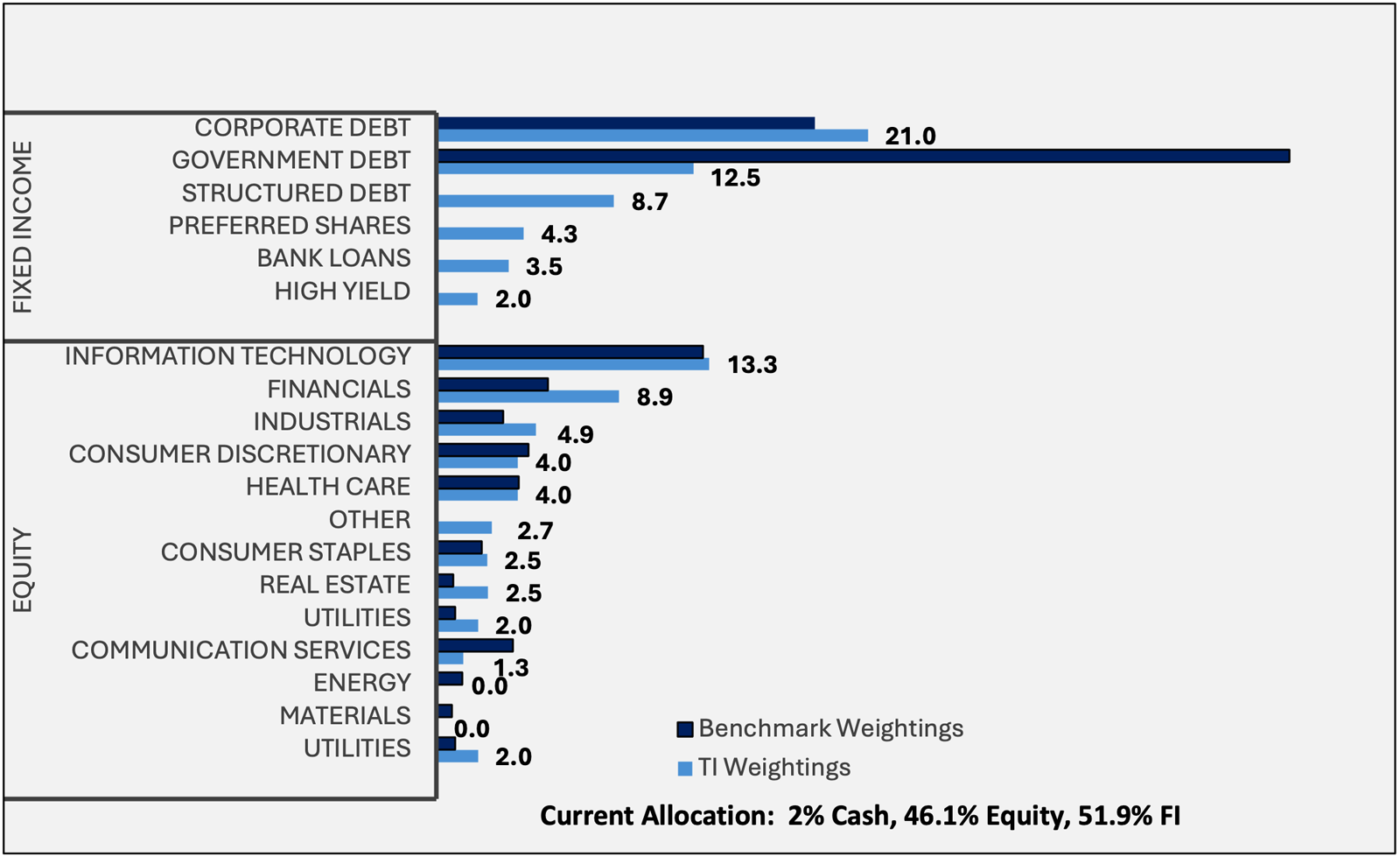

During Q4, Hilton Capital’s Investment Committee strategically calibrated portfolio risk, implementing small but impactful allocation adjustments to capitalize on shifting market dynamics while maintaining a prudent risk profile. Consequently, the asset allocation at the end of the fourth quarter was adjusted to approximately 51.9% fixed income (down from 52.7%), 46.1% equities (up from 45%), and 2% cash (flat versus prior quarter).

Figure 2: Tactical Income asset allocations

December 31, 2022 – December 31, 2024

Figure 2: Tactical Income asset allocations

Source: INDATA

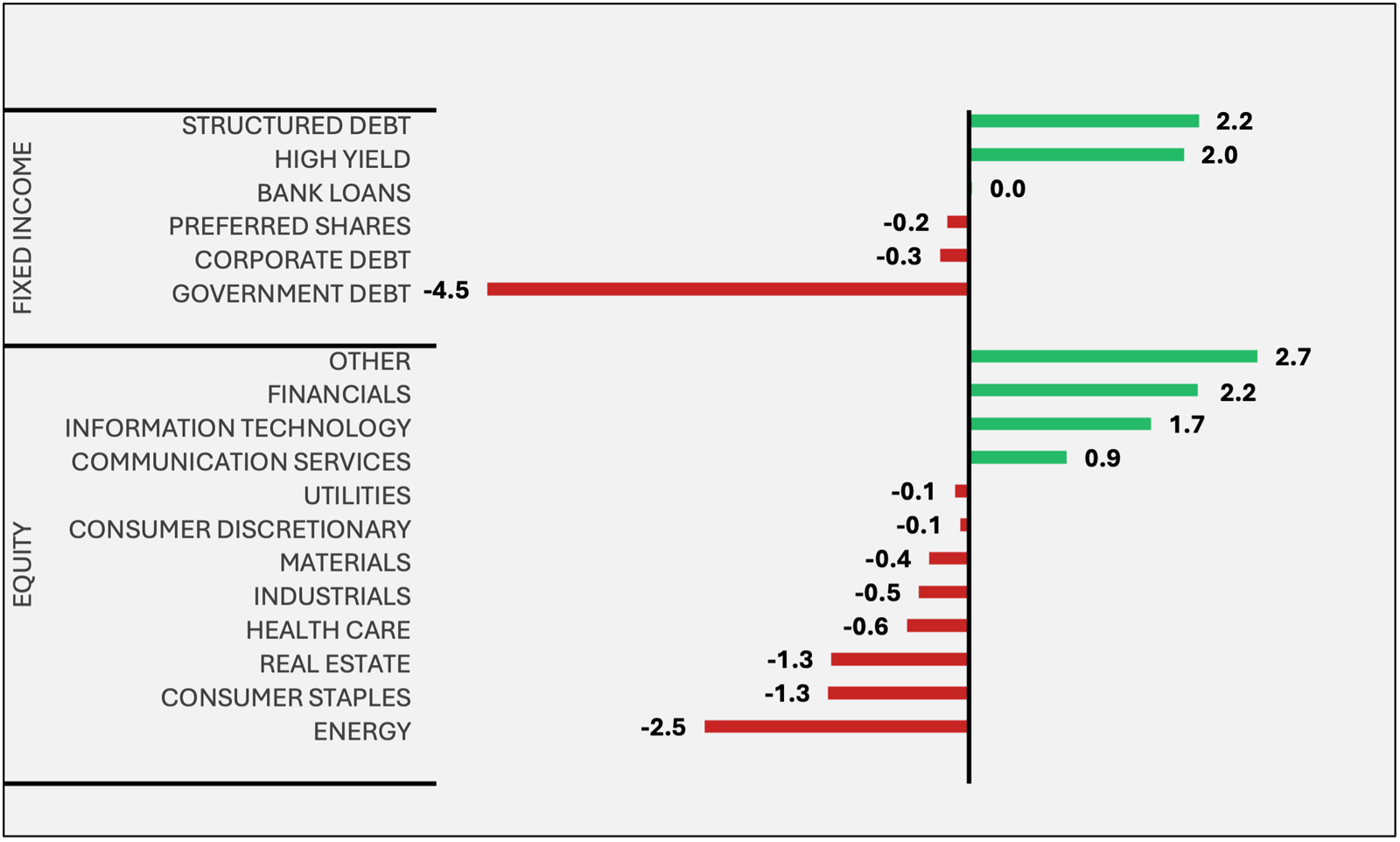

The following specific asset adjustments were made to the portfolio during the quarter.

Fixed Income: Early in the quarter, the Investment Committee reduced its position in Short-Term Treasuries (VGSH), redeploying capital to capitalize on near-term weakness in the portfolio’s core equity holdings. Subsequently post U.S. election, the portfolio management team executed a shift, reducing exposure to investment-grade mortgage-backed securities (MBB) in favor of short-duration credit risk through BBB-rated CLOs (JBBB) and High Yield Corporate Bonds (SHYG). This decision was driven by the Committee’s assessment that a combination of higher nominal GDP growth and an anticipated deregulatory environment would create favorable conditions for short-duration high yield credit securities.

Figure 3: Tactical Income 4Q24 Sector Allocation Changes

(In Percentage Terms)

Figure 3: Tactical Income 4Q24 Sector Allocation Changes

Source: INDATA

Equities: The investment team expanded the portfolio’s AI exposure by initiating stakes in select companies, in our opinion enhancing the equity allocation’s thematic alignment. Throughout the quarter, the Investment Committee initiated positions in META Platforms (META), IBM Corp (IBM), and Oracle Corp. (ORCL), while also bolstering its stake in Schneider Electric (SBGSY US ADR). These carefully selected additions represent firms we feel are market leaders within the expansive AI datacenter ecosystem. The Investment Committee executed these moves based on two key factors: attractive valuations and accretive yields to provide investors with compelling risk-return opportunities. Separately, to fund many of these acquisitions, the strategy reduced and / or exited its positions in S&P Communications Services (XLC), Republic Services (RSG), and LyondellBassell (LYB) given that both XLC and RSG’s valuations were near a decade high with lower earnings growth and return on invested capital potential compared to the new additions mentioned previously. As for LYB, the Investment Committee reevaluated two key company-specific developments: the lack of material divestiture announcements for its European assets and continued weak U.S. ISM figures. These factors invalidated the original investment thesis, prompting the Investment Committee to conclude that LYB no longer presented an attractive risk-reward proposition.

As the quarter progressed, the Investment Committee swapped FS KKR Capital BDC (FSK) for Golub Capital BDC (GBDC) based on valuation and credit quality concerns. Moreover, the strategy exited its position in Public Storage (PSA) based on the Investment Committee’s concerns with higher rates and continued housing weakness. Separately, the strategy liquidated its positions in Pepsi Co (PEP), Target Corp. (TGT), and Carrier Global Corp (CARR) due to stock-specific issues related to broader consumer health concerns, tougher retailer competition, and a potential IRA rollback, respectively. Lastly, the Investment Committee increased its position in Bank of America (BAC) and initiated new positions in Fidelity information Services (FIS) and Xylem (XYL) to capitalize on what we believe is market weakness while increasing the strategy’s weight to financials post U.S. election. As for XYL, the Investment Committee has long admired the company’s high-quality portfolio within the water treatment ecosystem as well as its highly recurring and accretive to margins software business for water quality data. We believe XYL represents a long-term holding opportunity for the strategy due to its exceptional management team, large moat within water management, and attractive dividend growth potential.

As the quarter ended, the Investment Committee ultimately exited its position in Alerian MLP (AMLP) as we believe that global oil prices could fall materially given increased supply from broader U.S. deregulation. In an effort to keep the strategy’s equity weight unchanged, the Investment Committee used AMLP’s capital to initiate a JEPI, a covered call ETF on the S&P 500 to maintain the strategy’s dividend yield.

Figure 4: Tactical Income Sector Weights v. Benchmark*

12/31/24

Figure 4: Tactical Income Sector Weights v. Benchmark*

Source: INDATA & Bloomberg

Performance: The Hilton Tactical Income Strategy demonstrated a relatively in-line performance in the fourth quarter, delivering a composite return of -0.37% gross / -0.49 % net for the fourth quarter. While the performance for the quarter was only down modestly, it slightly trailed the benchmark* return of -0.003% by 37 basis points gross / 49 basis points net, as illustrated in Figure 5. However, as mentioned previously, the strategy’s year-to-date performance has been solid. The composite generated a 11.39% gross / 10.85% net return, moderately outperforming the benchmark’s year-to-date return of 11.35%.

In previous communications, we highlighted our concerns that our primary benchmark no longer accurately reflects the Hilton Tactical Income Strategy. This is primarily due to its 40% allocation to the higher beta, technology-heavy S&P 500. Consequently, we find that the Morningstar Moderately Conservative Index serves is a more suitable benchmark for our strategy, given its focus on lower-beta, higher-yielding equity holdings. Against this secondary benchmark, the Hilton Tactical Income Strategy delivered impressive calendar year 2024 outperformance of 4.98% gross / 4.39% net. Additionally, during the fourth quarter, the strategy outperformed by 3.39% gross / 3.26% net. In terms of asset class contributions for the calendar year, equities added 9.46% to the total return, while fixed income contributed 1.87%.

Correspondingly, the Hilton Tactical Income Strategy remains steadfast in its primary objective of generating income, with capital appreciation serving as a secondary goal. This focus is clearly reflected in the strategy’s performance metrics for the quarter. As of the period's end, the strategy boasted an impressive, indicated yield of 4.44%, significantly outpacing both our benchmarks. This yield stands in stark contrast to the 3.17% offered by our primary benchmark.

Figure 5: Tactical Income Absolute and Relative Performance vs Benchmark* FY2024

Figure 5: Tactical Income Absolute and Relative Performance vs Benchmark* FY2024

Source: Bloomberg

Figure 6: Tactical Income Absolute and Relative Performance vs Secondary Benchmark FY2024

Figure 6: Tactical Income Absolute and Relative Performance vs Secondary Benchmark FY2024

Source: Bloomberg

Quick snapshot of Q4 Attribution

- Average Asset Allocation during 4Q24: 2% Cash, 45.7% Equity, 52.3% Fixed Income

- Yield on the portfolio as of 12/31/2024 was 4.44%.

- The Hilton Tactical Income Composite Q4 returned -0.37% gross / -0.49% net and modestly trailed the benchmark* return of -0.003% by 37 basis points gross / 49 basis points net.

- The Q4 underperformance was primarily a result of high-beta / non-yielding growth outperforming relative to our higher-quality / defensive growth-oriented equity positions and by maintaining a relatively shorter duration.

- The equity sector contribution to return was +0.25% which was 217bp behind the benchmark*, however, PLTR (103bps), TSLA (54bps), NFLX (26bps), GDDY (26bps) AMZN (18bps), and NVDA (11bps) were notable high beta / non-yielding equities that dragged down relative performance. We note that our equities portfolio must have a yield to be included in the portfolio.

- Consumer Discretionary and Communication Services were notable detracting sectors while Financials and Energy were notable outperforming sectors.

- Fixed Income contributed -86bp which was +74bp ahead of the benchmark*, notably due to the portfolio’s shorter duration relative to the benchmark*.

- The average duration of the fixed income portfolio is 3.13 which is below duration of the benchmark of 3.87. The average credit rating is A-.

Outlook

Hilton Capital’s Investment Committee remains committed to its proven hybrid investment strategy, seamlessly blending macro-economic insights with rigorous company-specific analysis. This nuanced approach has consistently demonstrated its efficacy in navigating complex market conditions, allowing us to adeptly respond to:

- Evolving economic indicators

- Shifts in Federal Reserve policy

- Company-specific developments and opportunities

By maintaining this balanced perspective, the Investment Committee continues to position the strategy to capitalize on emerging trends while mitigating potential risks. We believe that this dynamic methodology enables us to make informed, timely decisions that align with both short-term market movements and long-term investment objectives.

The Fed recently initiated its cutting cycle with a 100-basis point rate reduction; however, recent U.S. Dollar strength and higher longer-duration market rates convolute this easing cycle. The Investment Committee continues to believe that the Fed will prioritize its employment mandate over inflation concerns, given that Core PCE remains at a manageable sub 3%. While acknowledging mixed signs in labor market, particularly evident in a recent rebound in job openings and nonfarm payroll, the Investment Committee discerns no immediate indicators of an impending recession. Recent employment data has surpassed expectations, and the potential for a "Fed Put" provides an additional layer of economic support. These factors collectively justify maintaining the current asset allocation within the portfolio.

The Investment Committee maintains a cautious outlook on short-term market directions, anticipating increased volatility to various internal and external factors. The strategy is strategically structured to navigate and potentially benefit from these expected fluctuations going into 2025, reflecting our balanced, risk-aware approach. This strategy emphasizes flexibility and vigilance, positioning us to adapt to market shifts while aiming to optimize risk-adjusted returns. Our Investment Committee extends sincere gratitude to our valued investors for their unwavering trust and support. As we navigate the dynamic market landscape, we remain committed to our proven strategies and are optimistic about delivering robust relative performance in the coming year.

*Tactical Income Benchmark = 40% SPX TR Index / 60% Bloomberg Intermediate US Govt/Credit TR Index Value Unhedged.

Important Disclosures:

Hilton Capital Management, LLC (“HCM”) is a Registered Investment Advisor with the US Securities Exchange Commission. The firm only transacts business in states where it is properly notice-filed or is excluded or exempted from registration requirements. Registration as an investment advisor does not constitute an endorsement of the firm by securities regulators nor does it indicate that the advisor has attained a particular level of skill or ability.

The views expressed in this commentary are subject to change based on market and other conditions. The document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Sources include Bloomberg and INDATA (our portfolio accounting and performance system). There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All investing involves risks including the possible loss of capital. Asset allocation and diversification does not ensure a profit or protect against loss. Please note that out- performance does not necessarily represent positive total returns for a period. There is no assurance that any investment strategy will be successful. All investments carry a certain degree of risk. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited.

Additional Important Disclosures may be found in the HCM Form ADV Part 2A, which can be found at https://adviserinfo.sec.gov/firm/summary/116357.