HCM Insights

The Dollar Weighs Down U.S. Equity Markets

“Meaningful downward pressure.” These were Federal Open Market Committee (Fed) Chairman Powell’s words last week explaining a third consecutive rate hike of 0.75% in the fight against a defiantly steep U.S. inflation rate.

Still, one could say the U.S. equity markets are struggling under similar treatment. Friday’s thrashing closed out a week of losses reaching deep into -4% territory and a YTD decline past 22% for the S&P 500 Index and 23% for the broader Russell 3000. The market turmoil is due to a motley mix of factors, including slowing demand, declining earnings, a hawkish Fed, sticky inflation, and an increasingly strong dollar.

This last influence is particularly significant due to both the dollar’s inverse relationship to equity movement and its unusually high level currently.

With the help of an inverted dollar index scale, the graph below illustrates the strength of this relationship between stocks (represented by the S&P 500 Index) and the dollar: As of mid-September, the U.S. Dollar Index (DXY), which measures the dollar’s strength against a basket of foreign currencies, is up a staggering 18%. The more limited U.S. Trade Weighted U.S. Dollar Index is also up by a significant 11.5%.

S&P 500 vs. DXY & U.S. Trade Weighted Dollar

5/1/22 - 9/16/22

Source: Wolfe Research Portfolio Strategy, Federal Reserve, ICE, and Bloomberg.

Below, we explore what’s causing the dollar’s increase and its outsized impact on U.S. stock markets.

First, What Does it Mean for the Dollar to Get “Stronger”?

Finance 101 tells us that different currencies have different values. When compared against each other, these are called exchange rates. For example, let’s say one U.S. dollar ($1) has the equivalent value of 20 Mexican Pesos (20 MXN). Or 1 MXN is equal to $0.05. If a carton of milk costs $0.50, it would cost 10 MXN to purchase in the Mexican currency.

When a currency rises in value or strengthens, its purchasing power increases relative to other currencies. If our $1 has strengthened relative to the Mexican Peso, it will take more Pesos to buy that same carton of milk because each Peso is now worth fewer dollars. Extending our example a little further, let’s say $1 now has the equivalent value of 25 MXN. The exchange rate has changed. It would now cost 12.50 MXN to buy that same carton of milk that costs $0.50 because 1 MXN is now worth only $0.04.

Generally speaking, exchange rates float (or change in relative value) due to a complex array of factors, including supply and demand, currency flows in and out of countries, interest rates, and geo-political events and risks.

Why Is the Dollar Strengthening Now?

Currently, the dollar is strengthening relative to other currencies for various reasons. Here are just a few:

- Federal Reserve tightening. The Fed’s rate hikes can attract foreign investors hunting for more favorable investment opportunities relative to domestic options. However, to invest in the U.S., foreign investors must convert their currencies into U.S. dollars first. This drives up dollar demand and, by extension, the “price” of currency conversion, further strengthening the dollar.

In addition, the greater the interest rate differential between nations, the greater the effect. While central banks across the world have been raising rates to combat inflation, the Fed一after a relatively slow start一has moved a lot more aggressively recently. As the positive spread between U.S. and foreign rates widens, the impact of increased demand deepens.

In the graph below, the index value of the U.S. Trade weighted dollar increases in line with a widening positive spread between the U.S. one-year T-Bill and the comparable German bill.

U.S. Trade Weighted Dollar vs. U.S. Less German 1- Year

1/1/19 - 9/17/22

Sources: Wolfe Research Portfolio Strategy, Federal Reserve, and Bloomberg.

- Economic growth differential. Economic expansion has slowed everywhere due to a confluence of factors, including; inflation, hawkish central bank activity, ongoing coronavirus panic-induced shutdowns, and geo-political conflict. Still, on a relative basis, the U.S. economic outlook currently appears less pessimistic than elsewhere.

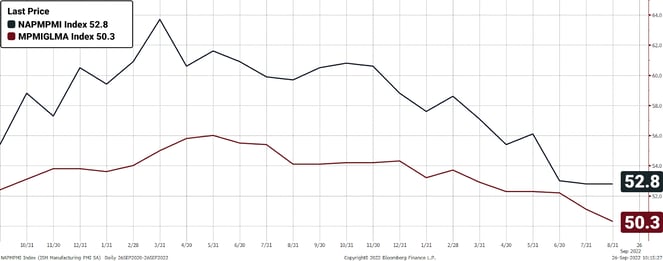

For example, August 2022’s level of the Institute of Supply Management (ISM) U.S. Manufacturing and Services PMI, a composite index illustrating product demand based on U.S. economic production, remained steady at July’s level of 52.8 percent, while its global counterpart declined to 50.3 percent一a 26-month low一and just north of the 50.0 neutral level.

ISM Manufacturing and Services PMI

10/1/21 - 8/31/22

Source: Bloomberg/Hilton Capital Management.

ISM Manufacturing = an index based on surveys of more than 300 manufacturing firms by the Institute of Supply Management. It monitors employment, production, inventories, new orders, and supplier deliveries.

MPMIGLMA= JPM Global Manufacturing PMI Index.

You cannot invest directly in an index.

The comparison is also quite stark compared to the Eurozone and the UK (with August levels under 50.0%), where economic growth is vulnerable to Russian war-driven energy shortages and price spikes.

- Increase in demand for “safe haven” U.S. Treasuries. Times of economic uncertainty and recession fears generally drive investors to seek shelter in less risky assets. This is visible in widening credit spreads as investors move out of lower-grade corporates and the like into safer U.S. Treasury securities. Similarly to the argument above, “risk-off” demand for dollar-denominated assets requires the conversion of investment capital to dollars, which drives up the price or strength of the dollar.

How Does the Dollar Impact U. S. Equity Markets?

As mentioned, dollar strength moves inversely to equities, and our current down markets are no exception. A strong dollar will drive equities lower for a host of reasons, including the following.

- Currency risk bruises overseas revenues. U.S.-based companies with overseas sales (or investments) in foreign currencies will eventually need to repatriate income back to dollars. Converting a weaker currency into the dollar will translate into fewer dollars, potentially impacting sales and profit expectations. Approximately 30% of S&P 500 Index revenues are generated overseas, which can significantly impact index performance.

The graph below illustrates that the amount of increasing earnings estimate revisions within S&P 500 Index companies decreases as the dollar gains strength.

The S&P 500 Index: Percent of “Up” Revisions vs. Trade Weighted Dollar

1/1/10 - 9/17/22

Source: Wolfe Research Portfolio Strategy, the Federal Reserve, Refinitiv, Standard & Poor’s, and FactSet.

- Trade Imbalance dampens growth. A trade imbalance occurs when a country’s imports exceed its exports. When the dollar is strong, exports suffer because foreign consumers pay more in their currency to purchase U.S. goods (think of our carton of milk example).

For U.S. consumers and corporates, imported goods一including inputs一will cost less, because the same amount of dollars will have greater purchasing power in a foreign market.

When exports (money in) grow more slowly than imports (money out), this can have a chilling effect on corporate growth and, by extension, equity returns. The graph below illustrates this effect.

U.S. Trade Balance vs. U.S. Trade Weighted Dollar

1/1/92 - 9/19/22

Source: Wolfe Research Portfolio Strategy, Bloomberg.

- Decline in foreign investments. When assets in the United States cost more, foreign investment declines. For the foreign investor, it will take more local currency to equal the same number of dollars. This is the case with hard assets, such as real estate, and securitized assets, such as real estate investment trusts (REITs), among others. This also tends to harm growth and equity markets.

What May Be Ahead for Investors

While it’s impossible to predict anything with certainty, it’s conceivable the dollar will remain strong for now. This is due to a series of factors, namely:

- Continued Fed tightening. Until the Fed is convinced inflation will return to normalized levels, we can expect additional rate hikes.

- Continued U.S. growth relative to foreign markets. Despite downward revisions in GDP, the U.S. continues to show a strong job market and less vulnerability to energy prices relative to its developed market counterparts一at least in the short term.

- Growing potential for Emerging Markets (EM) “blow-up risk.” For many emerging economies with dollar-denominated external debt, a strengthening dollar can be problematic. Debt service, paid in dollars, will become more expensive, increasing government spending. In the worst case一often called “EM blow-up risk”一as governments struggle with rising costs, capital exits the country and predictably seeks safety in the relatively secure U.S. dollar, thus causing a highly volatile negative feedback loop.

For EM countries connected to commodities markets, such as fuel, fertilizer, and metals, the risk can be mitigated by sustainably high prices thanks to ongoing supply chain challenges and geo-political conflict. Still, the risk can be significant for many EMs.

At Hilton, we’re acutely aware of the dollar and other macroeconomic forces potentially impacting our investment performance. As always, we remain vigilant as conditions unfold and are focused on positioning our portfolios to protect on the downside while capitalizing on the upside.