HCM Insights

TI Q1 25 Recap: Weathering Crosscurrents — Tactical Positioning Amid Shifting Fundamentals and Rising Risk Asymmetry

Hilton’s Tactical Income Strategy began 2025 with a heightened focus on risk calibration as evolving macroeconomic dynamics and geopolitical developments gave rise to a more asymmetric distribution of outcomes. In contrast to the relative stability of late 2024, the first quarter of 2025 introduced a new regime of policy uncertainty, widening global divergences, and accelerated shifts in capital allocation trends—necessitating a more defensive stance from our investment committee.

Throughout the quarter, our team took decisive action to reshape the portfolio in response to several key inflections. These included: (1) the mounting evidence that administrative reforms and fiscal tightening are lowering the trajectory of U.S. economic growth; (2) evidence of CapEx moderation in AI infrastructure following DeepSeek’s AI model breakthrough; and (3) renewed pressure on financials due to regulatory uncertainty and overextended valuations. These developments prompted a series of tactical adjustments aimed at preserving capital, increasing credit quality in our fixed income exposures, and recalibrating our equity holdings toward higher-quality, defensible growth.

Market Landscape and Macro Backdrop

The first quarter of 2025 marked a pronounced shift in the market’s risk posture. Volatility increased meaningfully as investors began to price in rising policy risk and a deterioration in forward economic visibility. Key macro headwinds emerged, including:

- An acceleration in federal job cuts via the Department of Government Efficiency (DOGE) alongside growing deportation efforts, resulting in possible private-sector spillover job losses and broader wage dislocation.

- A sharp deceleration in new housing starts and related ecosystem activity, further impairing economic momentum.

- Persistently high long duration yields and a depreciating U.S. Dollar, contributing to tighter financial conditions and increased funding stress.

- Softness in global demand, partly offset by rising European defense expenditures and a more constructive policy environment abroad.

Despite a volatile macroeconomic backdrop, the strategy delivered a solid performance relative to its primary benchmark, outperforming by a modest but meaningful margin. This relative strength highlights the team’s ability to tactically reposition the portfolio while avoiding many of the sector- and valuation-specific drawdowns that weighed on broader indices. Additionally, the indicated yield remained north of 4.3%, continuing to serve as a compelling differentiator amid income-constrained asset classes.

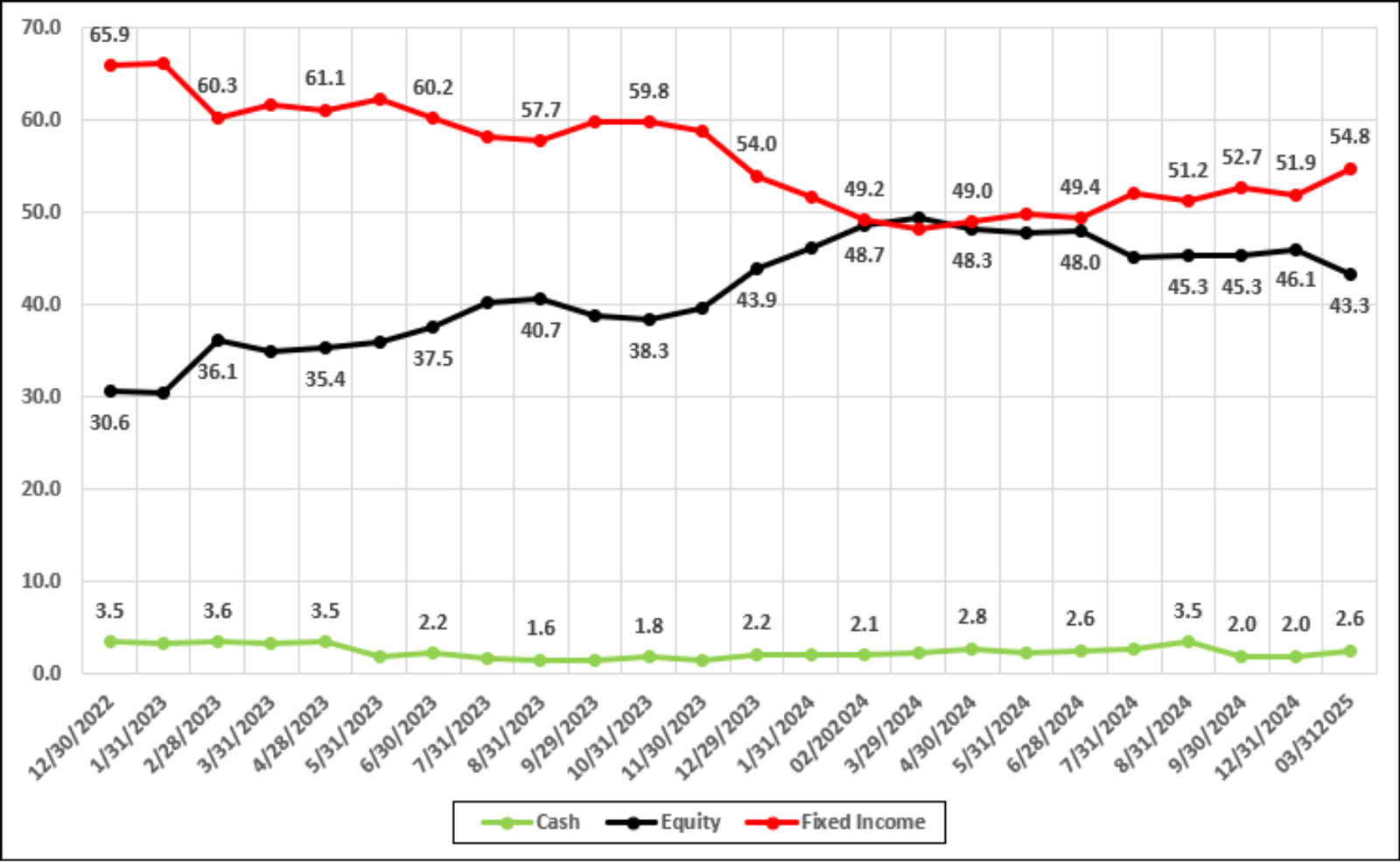

Notably, equity risk was actively reduced over the course of the quarter. The portfolio’s equity allocation declined from 46.1% to 43.3% by quarter-end as the team prioritized lower-beta exposures and leaned further into defensible, income-generating positions across sectors. These de-risking actions proved prescient ahead of what has now become known as “Liberation Day”—President Trump’s surprise announcement of an across-the-board ~25% tariff on all U.S. imports. While the event occurred shortly after quarter-end, it has already introduced a significant degree of market uncertainty and could materially reshape the investment landscape in future quarters.

Market Tailwinds During 1Q25:

- Continued Deregulation Expectations.

- Inflation: Core PCE at 2.8% (Decelerating from Jan.).

- Stable Energy Prices.

- 4Q24 Real GDP at 2.4%.

- Loosening Financial Conditions: 2YR / 10YR down ~35bps.

Market Headwinds During 1Q25:

- AI-CapEx Spend Potentially Overheating.

- Widening Credit Spreads (3.5% HY spreads from <3% in Jan.).

- Rising Trade Uncertainty.

- Extended Valuations (SPX trading +22x NTM EPS).

- Federal Employee Reduction / DOGE-related Spending Cuts.

Tactical Income Strategy 1Q25 Review:

At quarter-end, we reduced our overall equity exposure from 46.1% to 43.3%, while increasing fixed income exposure from 42.0% to 54.2%. Cash levels rose modestly to 2.6%. These moves reflect a deliberate reduction in portfolio risk based on our view that rising tariff uncertainty, elevated valuations across key sectors, slower-than-expected M&A activity, and a more tempered outlook for AI-related spending would likely limit upside over the near to medium term.

Figure 1: Tactical Income asset allocations

December 31, 2022 – March 31, 2025

Figure 1: Tactical Income asset allocations

Source: INDATA

The following specific asset adjustments were made to the portfolio during the quarter.

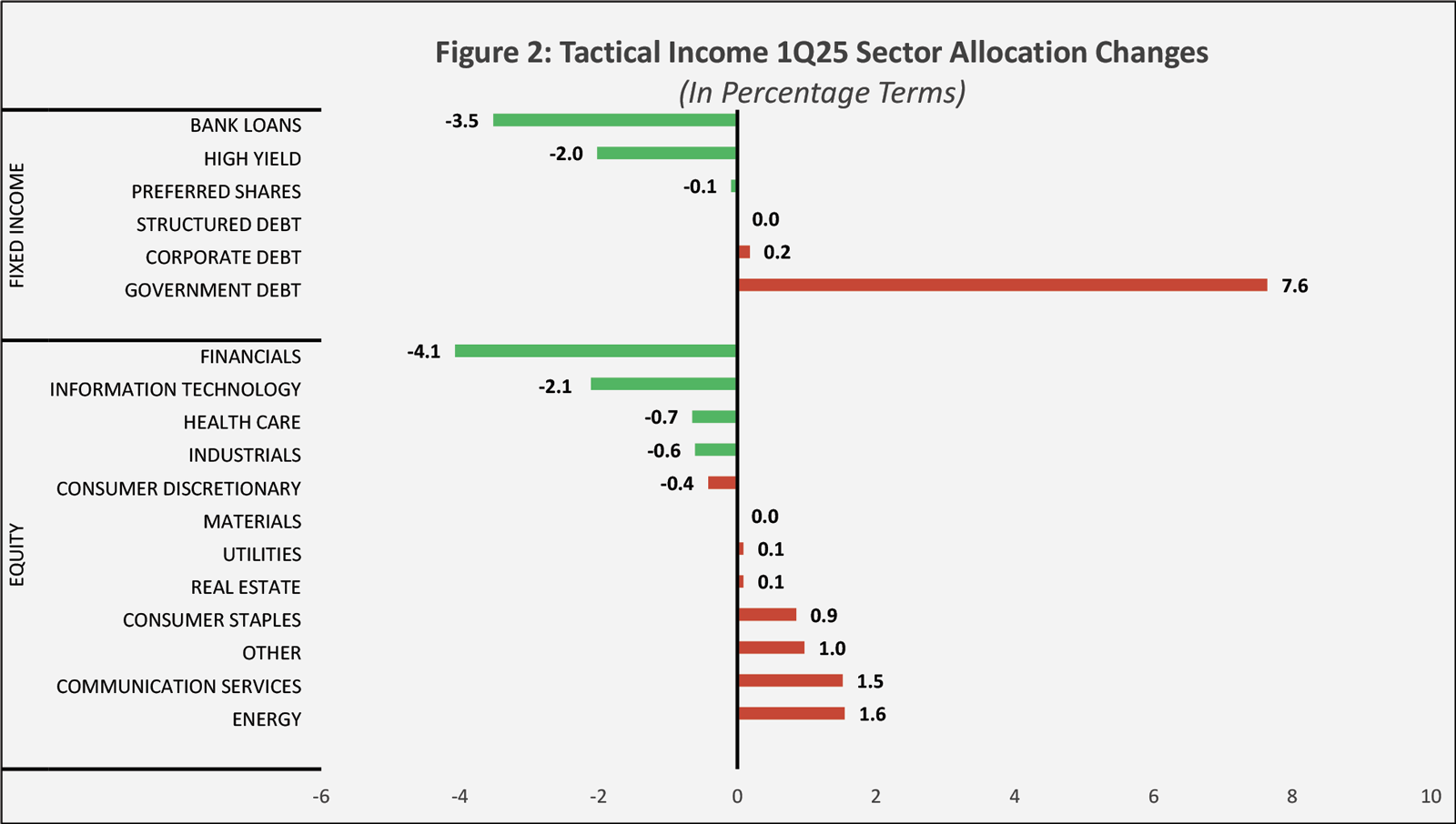

Fixed Income: Within the Fixed Income side of the portfolio, we tactically extended duration and upgraded credit quality. We meaningfully increased our exposure to agency mortgage-backed securities (MBB) and intermediate Treasuries (SCHR/VGIT), raising our MBS allocation to ~12%. Spreads at over 124 basis points (at the time) relative to Treasuries offered a compelling entry point, particularly in light of our more cautious macro-outlook. We also exited positions in lower-rated credit exposures—including floating-rate loans (SRLN) and high yield bonds (SHYG)—to reduce downside risk in the event of a downward GDP growth revision or broader credit spread widening. These shifts reflect our belief that asymmetric risk has widened in public markets, and that capital preservation and income stability are now paramount.

Figure 2: Tactical Income 1Q25 Sector Allocation Changes

(In Percentage Terms)

Figure 2: Tactical Income 1Q25 Sector Allocation Changes

Source: INDATA

Equities: Throughout 1Q2025, the investment committee made a series of deliberate, data-driven reallocations, summarized as follows:

- AI Hardware Repositioning: Following DeepSeek’s unexpected AI model announcement, we trimmed our holdings in Taiwan Semiconductor (TSM), Broadcom (AVGO), and ultimately exited AVGO. We also sold Schneider Electric (SBGSY), a global industrial electrification company. These moves were driven by our belief that the efficiency of DeepSeek’s model could significantly reduce GPU demand and depress forward CapEx in hyperscaler data centers. We correspondingly increased our position in META, which stands to benefit from more cost-effective AI scaling.

- Rebuilding Energy Exposure: We initiated and subsequently increased our position in Williams Companies (WMB), a high-conviction name with strategic leverage to long-term natural gas demand, data center expansion, and LNG export growth. WMB’s differentiated asset footprint and stable yield profile made it a compelling fit as we sought to re-anchor parts of the portfolio in lower-beta, income-generating infrastructure assets.

- Defensive Rotation Within Financials, Industrials and Healthcare: We exited positions in UnitedHealth (UNH), Merck (MRK), Goldman Sachs (GS), Wells Fargo (WFC), and Bank of America (BAC) based on a combination of valuation, headline risk, and diminishing risk/reward. We added modest exposure to Procter & Gamble (PG), reflecting a strategic shift toward more defensive, cash-flow-stable franchises in the face of rising macroeconomic risk. Additionally, some longer held names APO, ARES, BAH and TRI were trimmed early in the quarter.

- Selective Re-entry into Quality Growth: Alphabet (GOOGL) was added following a material valuation reset and improved sentiment around monetization of its AI tools and YouTube platform. We also initiated a position in T-Mobile (TMUS), given its leading 5G footprint, robust balance sheet, long-term dividend growth profile. We also purchased Cisco (CSCO) which is emerging as a key supplier of datacenter networking solutions.

- Increased International Equity: We increased our European exposure with a new position in the FTSE Europe ETF (VGK) and adding to 3i Group (TGOPY). This rotation was driven by two factors: (1) improving policy conditions in the EU—particularly Germany’s re‑industrialization initiatives, which are set to spur capital investment—and (2) heightened tariff uncertainty and a less predictable regulatory backdrop in the United States, prompting diversification away from U.S. equities. European valuations remain attractive on both relative and historical measures, and several of our international holdings stand to gain from favorable currency trends and a gradual normalization of global trade flows.

Performance: Following an exceptional year in 2024, the Hilton Tactical Income Strategy entered 2025 well-positioned to manage increasing macroeconomic volatility. As we’ve previously highlighted, the strategy delivered strong outperformance relative to both our primary and secondary benchmarks in 2024. The composite generated a gross return of 11.39% / net return of 10.85%, compared to 11.35% for the primary benchmark and 6.41% for the Morningstar Moderately Conservative benchmark. This impressive result reflected the portfolio’s balanced positioning, superior equity selection, and the ongoing benefits of its multi-asset structure.

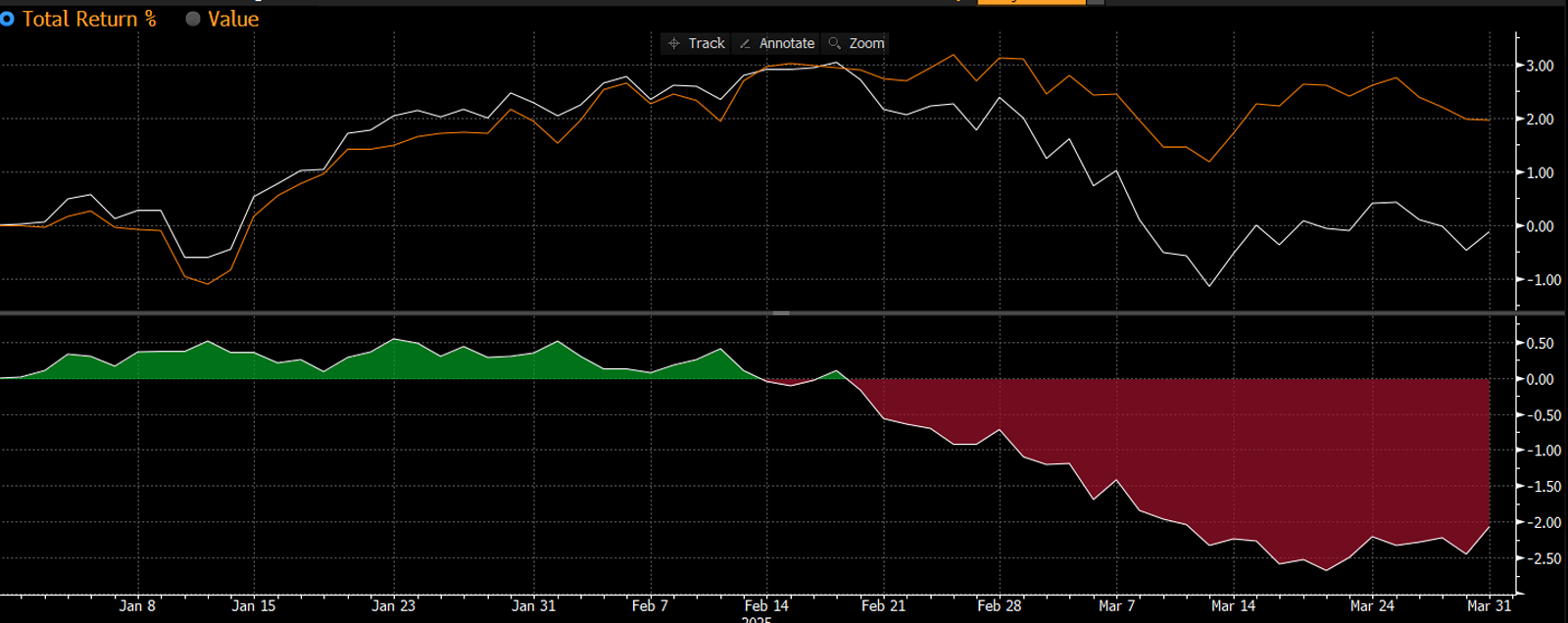

In Q1 2025, amid rising volatility, administrative policy shifts, and tightening financial conditions, the portfolio modestly declined on an absolute basis yet outperformed its primary benchmark. This relative strength reflects the team’s proactive de-risking throughout the quarter, strong yield profile, and emphasis on defensive growth equities across technology, communication services, and industrials.

Hilton Tactical Income vs. Primary Benchmark – Q1 2025

Tactical Income Composite: -0.12% vs. Benchmark: -0.30%

Outperformance driven by quality bias, strong yield, and timely equity de-risking.

As shown above, the strategy maintained a performance lead throughout most of the quarter, with performance dispersion tightening modestly into quarter-end. Our high-conviction equity holdings, combined with an income-oriented fixed income allocation, enabled the strategy to weather early-quarter volatility and outperform in a broadly down market.

In contrast, performance versus our secondary benchmark—the Morningstar Moderately Conservative Index—was less favorable. The benchmark posted a strong gain of nearly +2.0%, significantly outpacing the composite’s modest decline. This underperformance was primarily attributable to the benchmark’s larger allocation to international equities, which benefited from European defense stimulus, ECB easing expectations, and relative currency strength. Additionally, its overweight to low-growth sectors such as consumer staples and healthcare provided ballast during periods of market stress.

Hilton Tactical Income vs. Secondary Benchmark – Q1 2025

Tactical Income Composite: -0.12% vs. Benchmark: +1.95%

Underperformance driven by benchmark’s international equity exposure and defensive sector bias.

Even so, we remain confident in our current positioning. Our indicated yield of over 4.3% remains highly competitive in the current market landscape, and our beta-adjusted equity weight ended the quarter at ~35%, reflecting the team’s commitment to preserving downside protection while maintaining upside participation. As we noted earlier, these results came just ahead of President Trump’s "Liberation Day" tariff announcement, which introduced a 25% blanket tariff on all U.S. imports and materially altered the investment landscape heading into Q2.

Figure 3: Tactical Income Absolute and Relative Performance vs Benchmark* 1Q25.

Figure 3: Tactical Income Absolute and Relative Performance vs Benchmark* 1Q25.

Source: Bloomberg. White line represent Hilton Tactical Income and orange line represents primary benchmark.

Figure 4: Tactical Income Absolute and Relative Performance vs Secondary Benchmark 1Q25.

Figure 4: Tactical Income Absolute and Relative Performance vs Secondary Benchmark 1Q25.

Source: Bloomberg. White line represent Hilton Tactical Income and orange line represents secondary benchmark.

Quick Snapshot of 1Q Attribution:

- Average Asset Allocation during 1Q25: 2.3% Cash, 44.9% Equity, 52.8% Fixed Income.

- Yield on the portfolio as of 03/31/2025 was 4.40%.

- The Hilton Tactical Income Composite Q4 returned -0.12% gross / -0.28% net and modestly beat the benchmark* return of -0.30% by 18 basis points gross / 54 basis points net.

- 1Q outperformance was primarily a result of the overweight positions in higher-quality / defensive growth and international equity positions. The fixed income holdings modestly trailed the bench due to TI’s shorter duration exposure.

- The equity sector contribution to return was -2.5% which was 178bp ahead of the benchmark*. Notable contributions were from our underweight positions in the consumer discretionary and communication services sectors.

- Financials and Energy were notable detracting sectors while Information Technology and Industrials were notable outperforming sectors.

- Fixed Income contributed +1.68% which was -75bp behind of the benchmark*, notably due to the portfolio’s shorter duration relative to the benchmark* and mortgage spreads widening.

- The average duration of the fixed income portfolio is 3.7, which is roughly in-line with duration of the benchmark. The average credit rating is A+.

Outlook:

Following quarter-end, we further de-risked the portfolio in response to the Trump administration's announcement of “reciprocal” tariffs, which averaged an unexpected ~25% across U.S. imports—significantly higher than prior expectations. This development introduced substantial uncertainty into our domestic macro-outlook and, in our view, materially increased the probability of a recession in the second half of the year. As a result, we exited positions in credit-sensitive / Asian exposure names including Ares Capital (ARCC), OWL, GBDC and ADI, along with further reductions to high-yield and preferred exposures (PFF, JBBB). These decisions were rooted in growing concerns around tightening financial conditions, rising spreads, and vulnerability in the private credit markets.

We also allocated additional capital into VGIT (intermediate Treasuries), reflecting a continued move toward higher credit quality and greater duration. While we modestly increased equity exposure via a new position in BlackRock (BLK) after the administration moderated its tariff rhetoric, the portfolio remains conservatively positioned. We continue to monitor macro developments closely and remain prepared to adjust exposure further as clarity emerges.

The portfolio has been further de‑risked: equity exposure now sits at our neutral allocation, and cash balances have climbed to roughly 7 percent. This measured shift responds to lingering uncertainty over tariff policy, sharp swings in interest rates, and fragile macro sentiment. Because conditions remain highly fluid, we are watching the surge in long‑dated Treasury yields and the simultaneous weakness in the U.S. dollar. This rare combination of signals heightens our concern that growth momentum could deteriorate materially before year‑end.

Accordingly, we have taken a more defensive posture, with beta-adjusted equity exposure now near 35% and no exposure to high-yield credit. Our elevated cash position gives us flexibility to act swiftly should volatility create dislocations or more attractive entry points. We believe ongoing market turbulence will ultimately provide compelling opportunities to initiate or add to extremely high-quality equities that we previously avoided due to elevated valuations. Patience and discipline will be essential in the coming months, and we are prepared to lean in where risk-reward turns decisively in our favor.

*Tactical Income Benchmark = 40% SPX TR Index / 60% Bloomberg Intermediate US Govt/Credit TR Index Value Unhedged.

Important Disclosures:

Hilton Capital Management, LLC (“HCM”) is a Registered Investment Advisor with the US Securities Exchange Commission. The firm only transacts business in states where it is properly notice-filed or is excluded or exempted from registration requirements. Registration as an investment advisor does not constitute an endorsement of the firm by securities regulators nor does it indicate that the advisor has attained a particular level of skill or ability.

The views expressed in this commentary are subject to change based on market and other conditions. The document contains certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Sources include: Bloomberg and INDATA (our portfolio accounting and performance system). There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

All investing involves risks including the possible loss of capital. Asset allocation and diversification does not ensure a profit or protect against loss. Please note that out- performance does not necessarily represent positive total returns for a period. There is no assurance that any investment strategy will be successful. All investments carry a certain degree of risk. Dividends are not guaranteed, and a company’s future ability to pay dividends may be limited.

Additional Important Disclosures may be found in the HCM Form ADV Part 2A, which can be found at https://adviserinfo.sec.gov/firm/summary/116357.